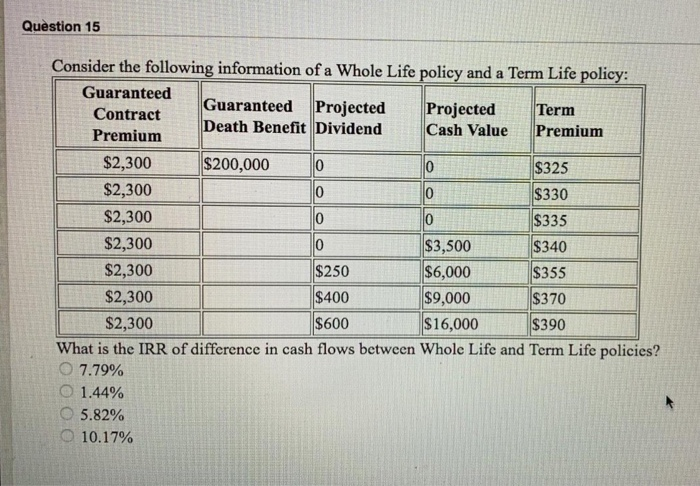

Question: Question 15 Consider the following information of a Whole Life policy and a Term Life policy: Guaranteed Contract Guaranteed Projected Projected Term Premium Death Benefit

Question 15 Consider the following information of a Whole Life policy and a Term Life policy: Guaranteed Contract Guaranteed Projected Projected Term Premium Death Benefit Dividend Cash Value Premium $2,300 $200,000 $325 $2,300 $330 $2,300 0 $335 $2,300 O $3,500 $340 $2,300 $250 $6,000 $355 $2,300 $400 $9,000 $370 $2,300 $600 $16,000 $390 What is the IRR of difference in cash flows between Whole Life and Term Life policies? O 7.79% 1.44% O 5.82% 10.17%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts