Question: Question 15 How much should you pay for a share of stock that offers a constant growth rate of 10%, requires a 16% rate of

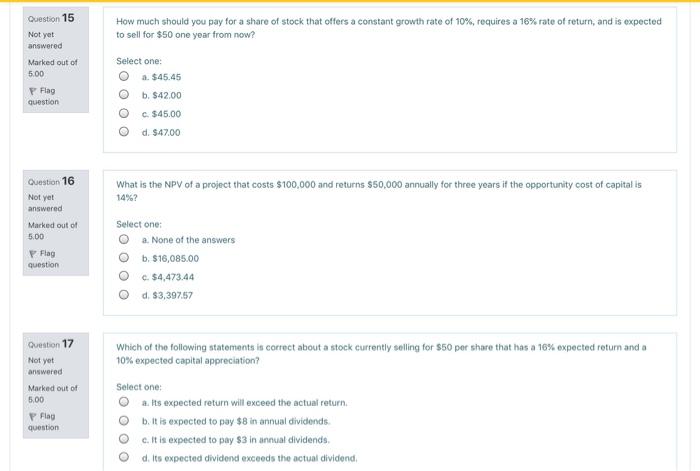

Question 15 How much should you pay for a share of stock that offers a constant growth rate of 10%, requires a 16% rate of return, and is expected to sell for $50 one year from now? Not yet answered Marked out of 500 Select one: O a $45.45 b. $42.00 P Flag question c. $45.00 d. $47.00 Question 16 What is the NPV of a project that costs $100,000 and returns $50,000 annually for three years it the opportunity cost of capital is 14%? Not yet answered Marked out of 5.00 Flag question Select one: a. None of the answers b. $16,085.00 c. $4,473.44 d. $3,397.57 Question 17 Which of the following statements is correct about a stock currently selling for $50 por share that has a 16% expected return and a 10% expected capital appreciation? Not yet answered Marked out of 5,00 P Flag question Select one: a. Its expected return will exceed the actual return b. It is expected to pay $8 in annual dividends. c. It is expected to pay $3 in annual dividends d. Its expected dividend exceeds the actual dividend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts