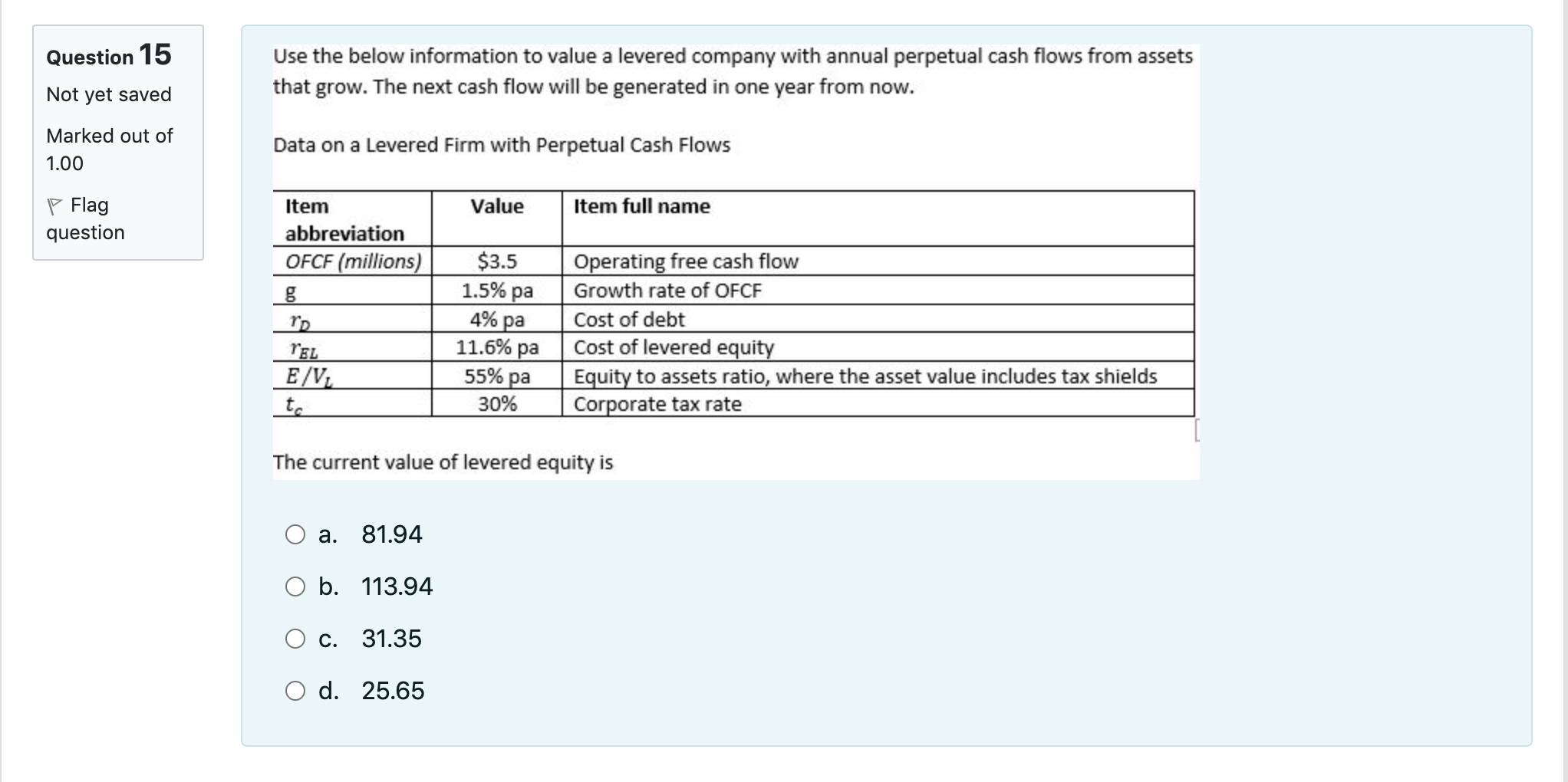

Question: Question 15 Use the below information to value a levered company with annual perpetual cash flows from assets that grow. The next cash flow will

Question 15 Use the below information to value a levered company with annual perpetual cash flows from assets that grow. The next cash flow will be generated in one year from now. Not yet saved Marked out of 1.00 Data on a Levered Firm with Perpetual Cash Flows Value Item full name P Flag question Item abbreviation OFCF (millions) g $3.5 1.5% pa 4% pa 11.6% pa 55% pa Operating free cash flow Growth rate of OFCF Cost of debt Cost of levered equity Equity to assets ratio, where the asset value includes tax shields Corporate tax rate TEL E/ ta 30% The current value of levered equity is a. 81.94 b. 113.94 c. 31.35 O d. 25.65

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts