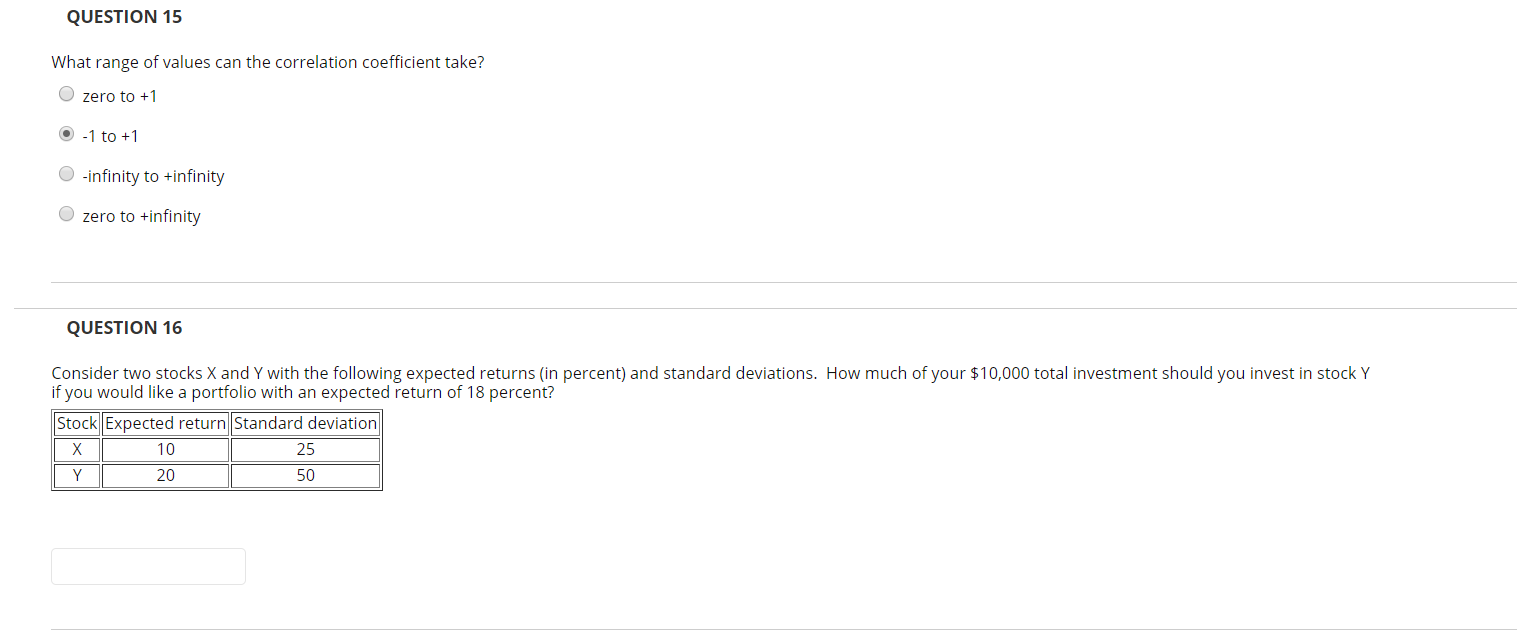

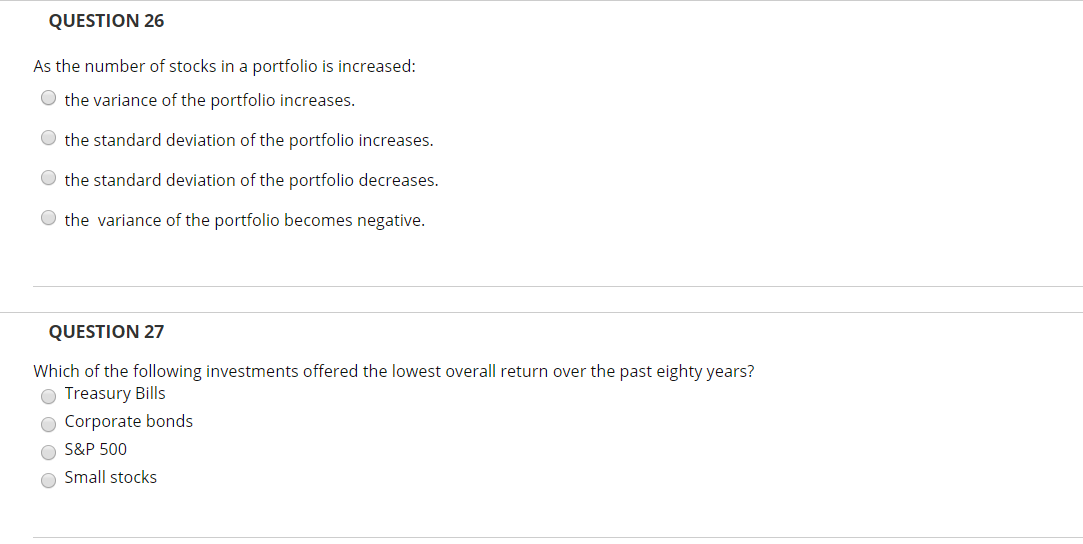

Question: QUESTION 15 What range of values can the correlation coefficient take? 0 zero to +1 @ -1 to M O -innityto +innity 0 zero to

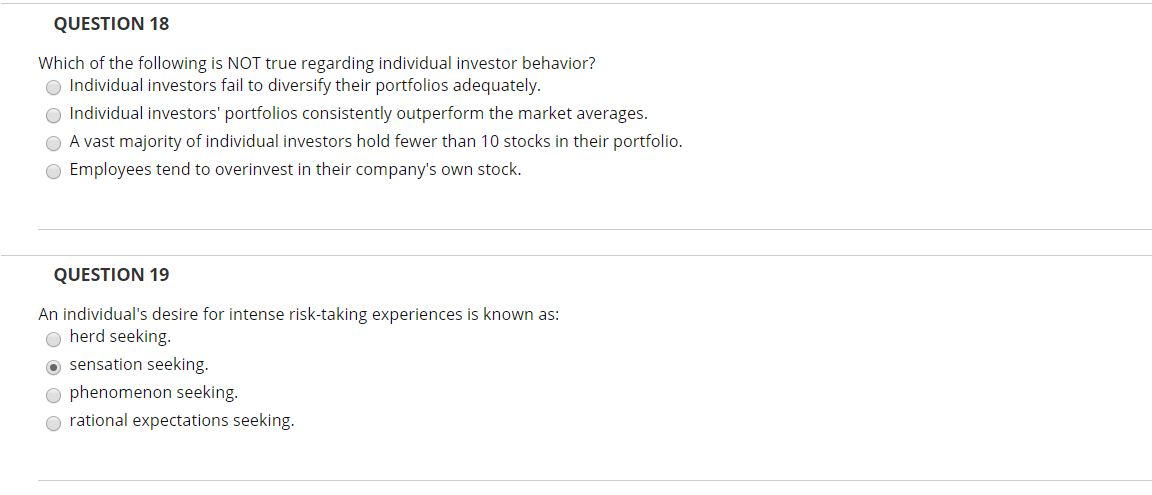

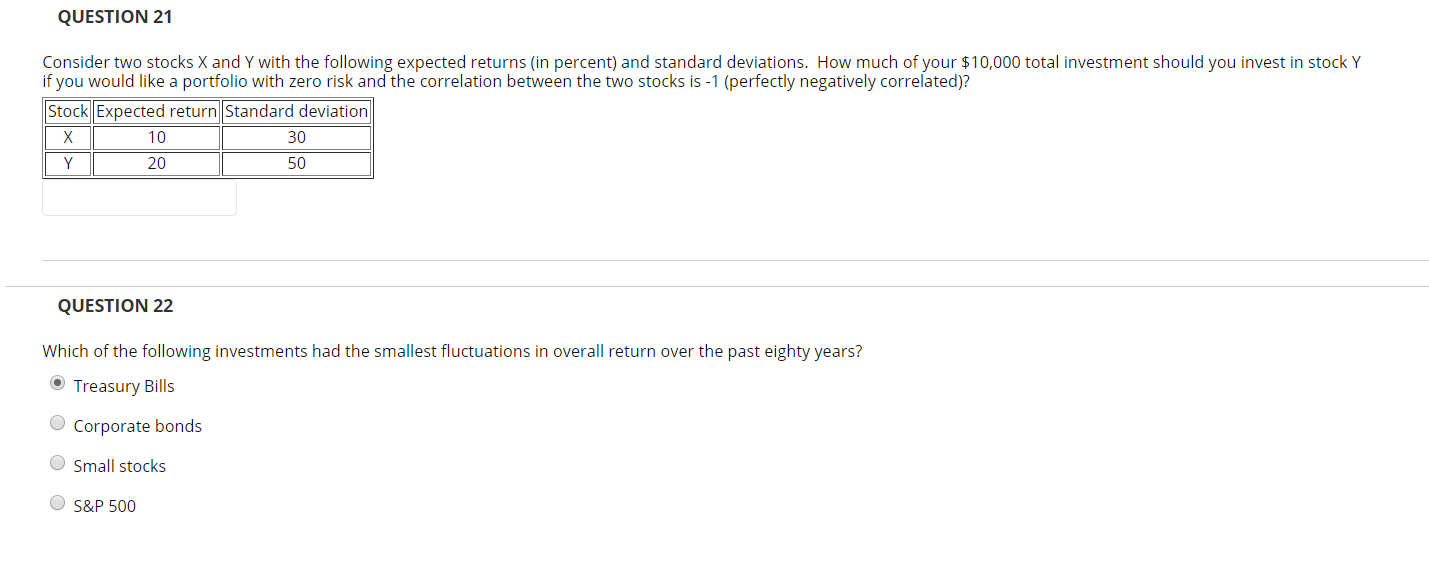

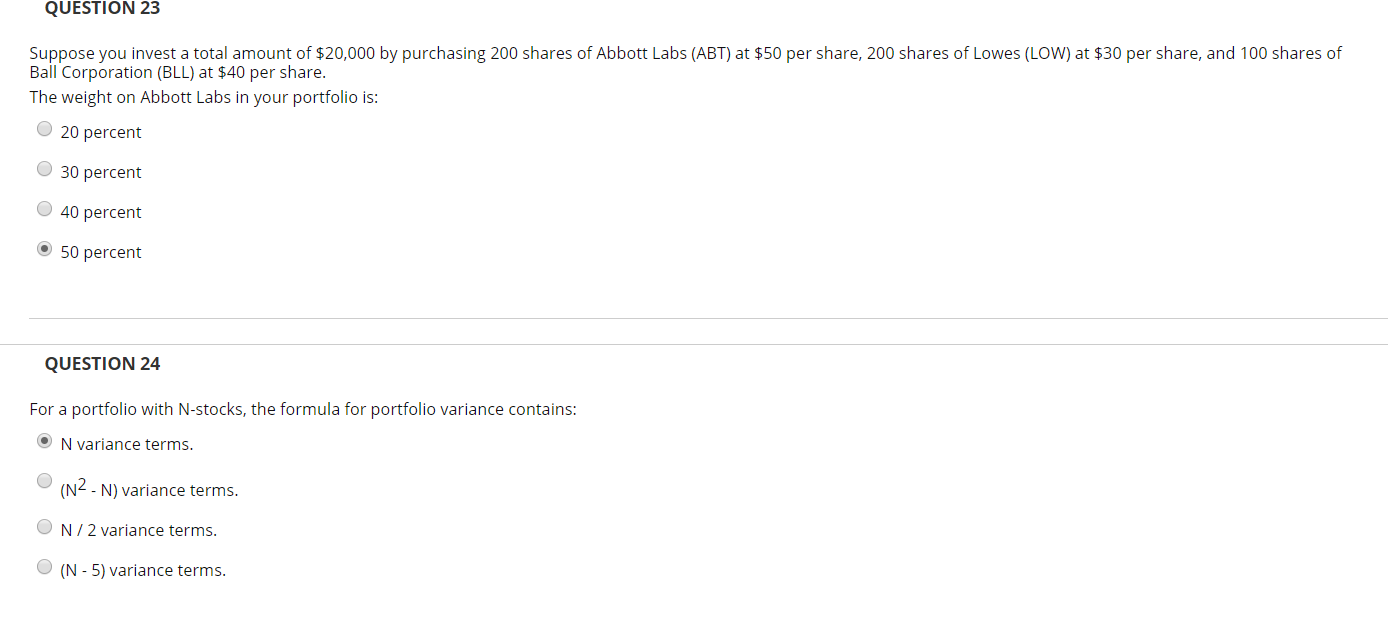

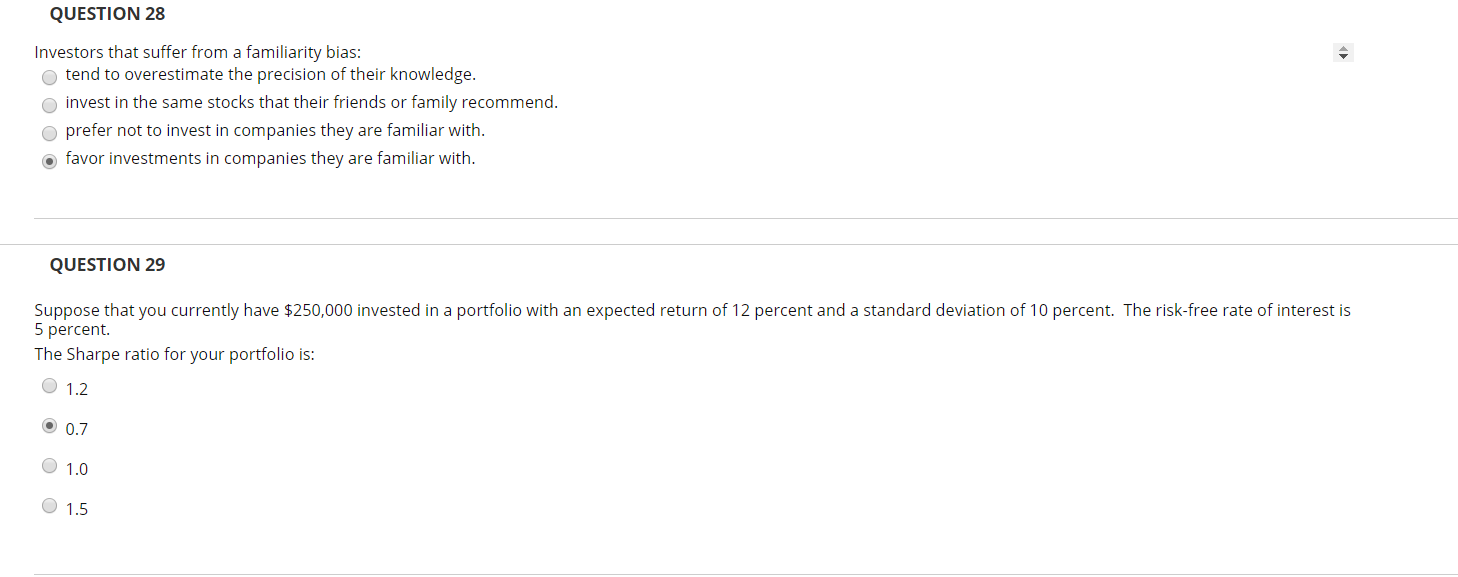

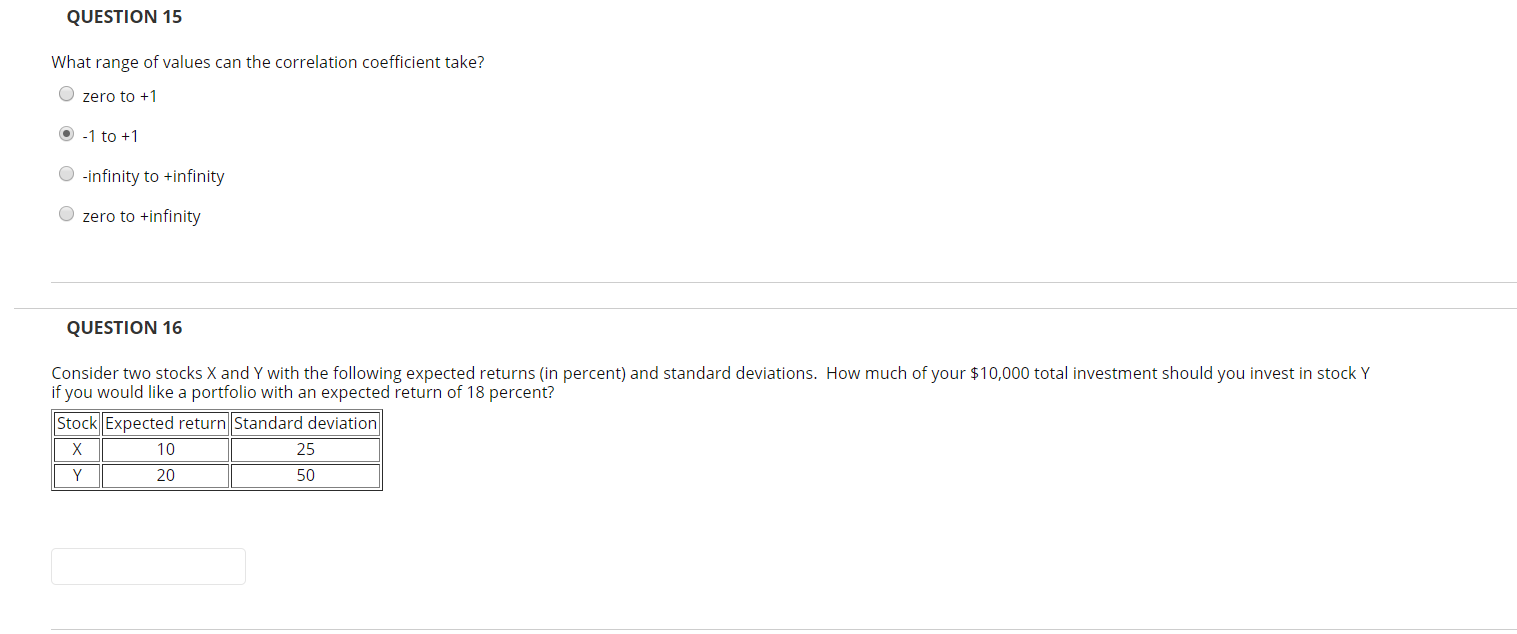

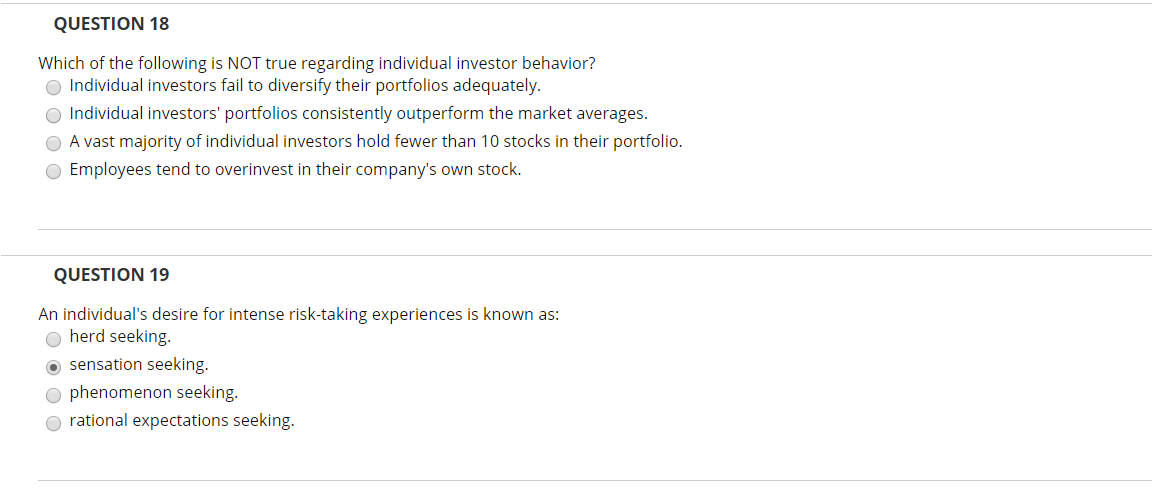

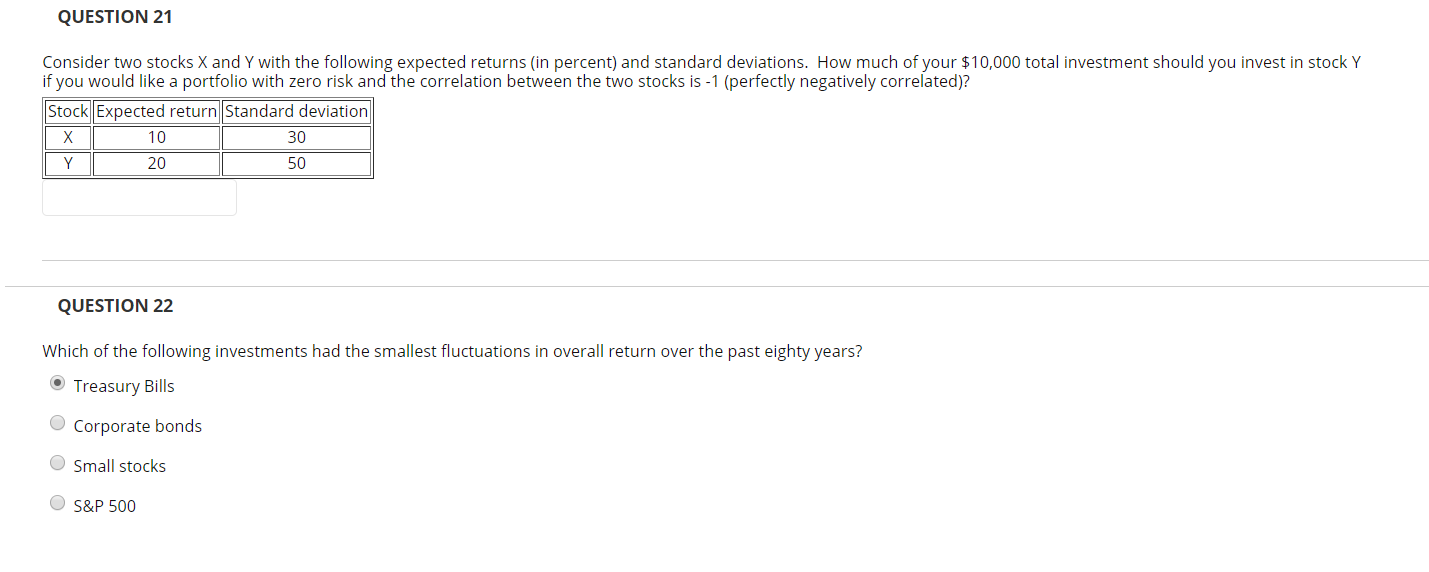

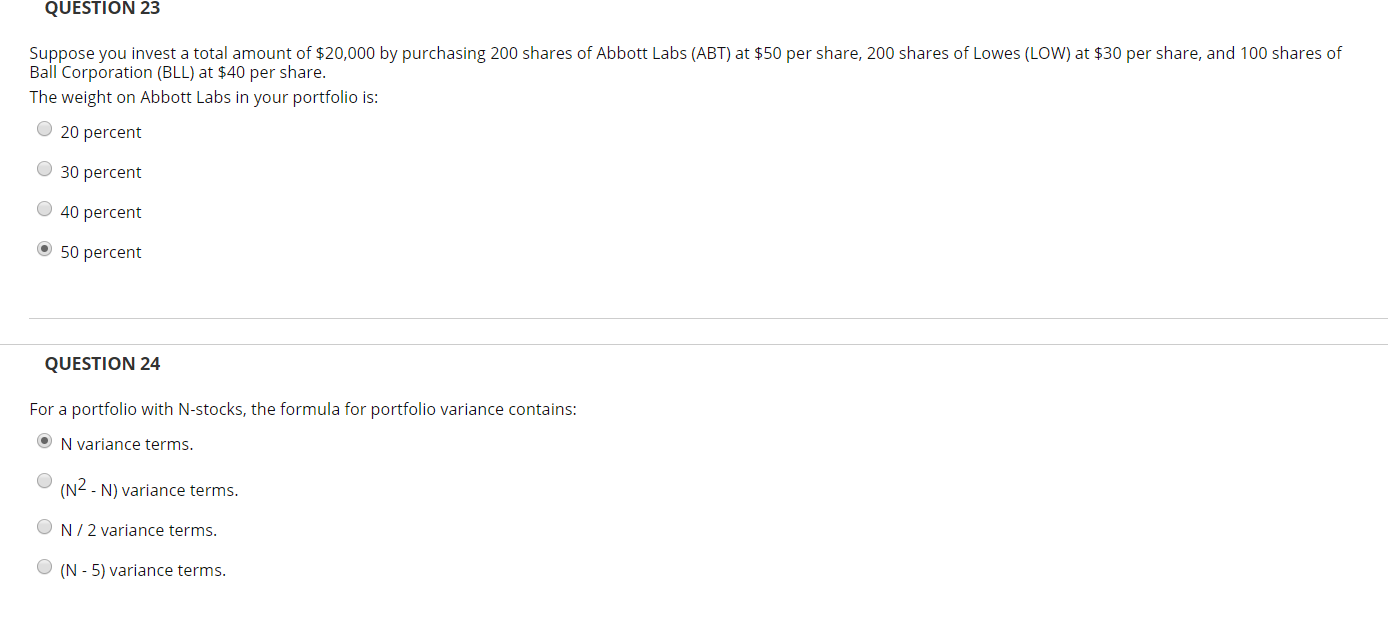

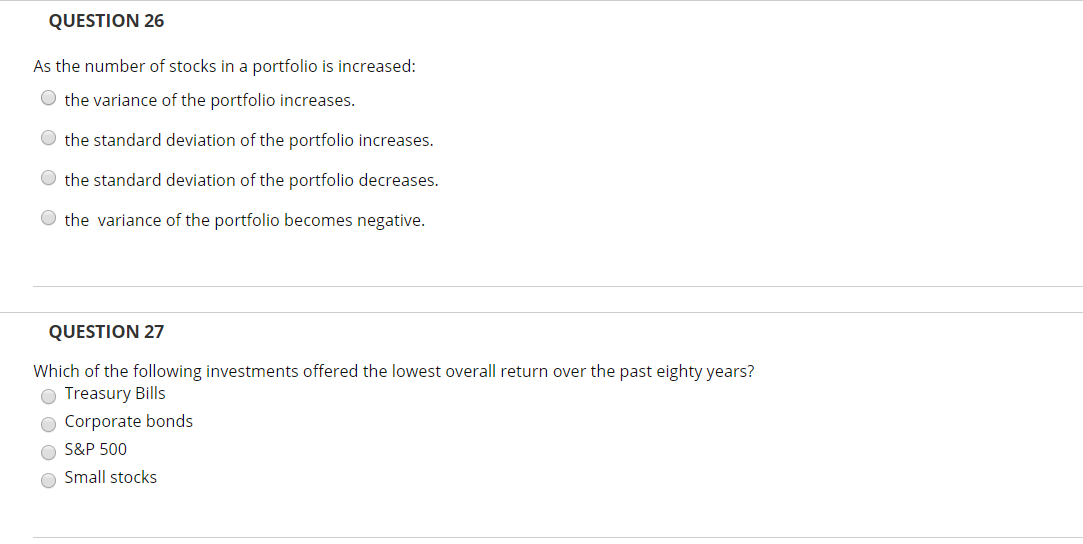

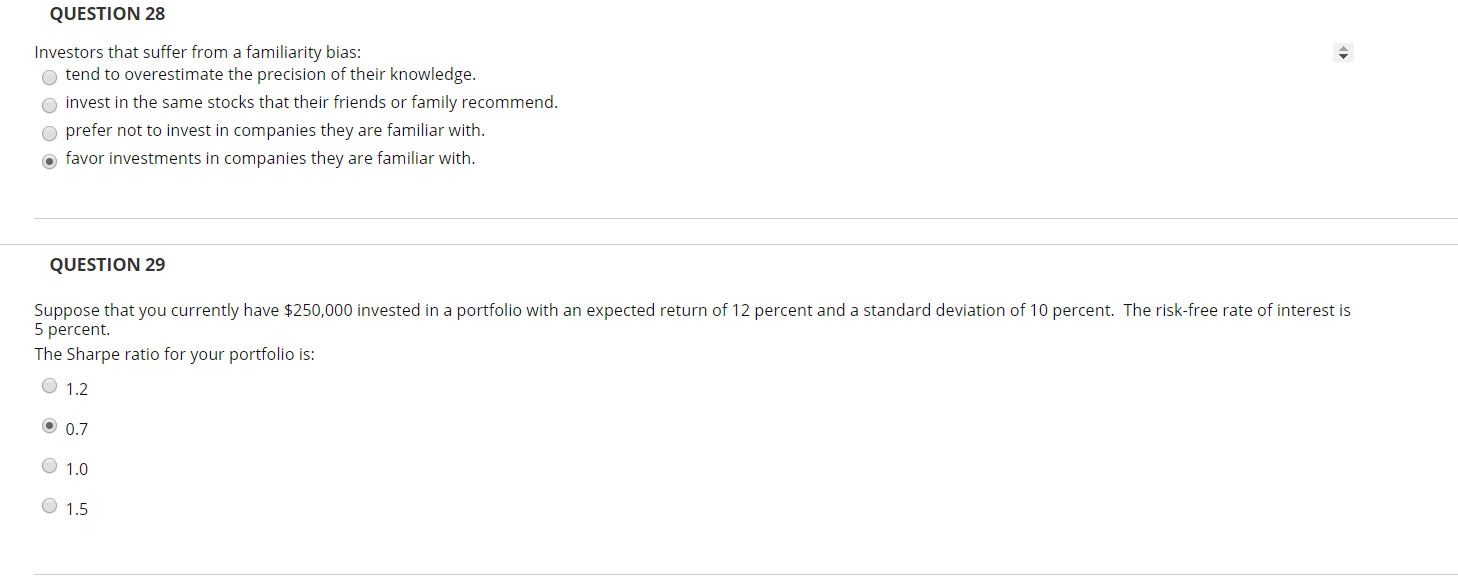

QUESTION 15 What range of values can the correlation coefficient take? 0 zero to +1 @ -1 to M O -innityto +innity 0 zero to +innity QUESTION 16 Considertwo stocks X and Vwith tne following expected returns (in percent) and standard deviations. How mucn ofyour $10,000 total investment should you invest in stock Y ifyou would like a portfolio with an expected return of'iB percent? Stock Expected return Standard deviation X 10 25 V 20 50 QUESTION 18 Which of the following is NOT true regarding individual investor behavior? 0 Individual investors fail to diversify their portfolios adequately. 0 Individual investors' portfolios consistently outperform the market averages. O A vast majority of individual investors hold fewer than 'IO stocks in their portfolio. 0 Employees tend to overinvest in their company's own stock. QUESTION 19 An individual's desire for intense risktaking experiences is known as: O herd seeking. @ sensation seeking. O phenomenon seeking. O rational expectations seeking. QUESTION 21 Considertwo stocks X and Y with the following expected returns (in percent) and standard deviations How much ofyour $10,000 total investment should you invest in stotk Y ifyou would like a portfolio with zero risk and the correlation between the two stocks is -1 (perfectly negatively correlated)? Stotk Expected return Standard deviation X it] 30 Y 20 50 QUESTION 22 Which of the following investments had the smallest uctuations in overall return over the past eighty years? Treasury Bills 0 Corporate bonds 0 Small stocks 0 S&P 500 QUESTION 23 Suppose you invest a total amount of $20,000 by purchasing 200 shares ofAbbott Labs (ABT) at $50 per share, 200 shares of Lowes (LOW) at $30 per share. and 100 shares of Bali Corporation (BLL) at $40 per share. The weight on Abbott Labs in your portfolio is: O 20 percent 0 30 percent 0 40 percent 50 percent QUESTION 24 For a portfolio with Nestocks, the formula for portfolio variance contains: N variance terms. 0 (N2 , N) variance terms. 0 N l 2 variance terms. 0 (N 5) variance terms. QUESTION 26 As the number of stocks in a portfolio is increased: 0 the variance ofthe portfolio increases. 0 the standard deviation of the portfolio increases. 0 the standard deviation of the portfolio decreases. O the variance ofthe portfolio becomes negative. QUESTION 27 Which of the following investments offered the lowest overall return over the past eighty years? 0 Treasury Bills 0 Corporate bonds 0 S&P 500 0 Small stocks QUESTION 28 0 Investors that suffer from a familiarity bias: 0 tend to overestimate the precision oftheir knowledge. 0 invest in the same stocks that their friends or family recommend. 0 prefer not to invest in companies they are familiar with. favor investments in companies they are familiar with. QUESTION 29 Suppose that you currently have $250,000 invested in a portfolio with an expected return of i 2 percent and a standard deviation of 1 0 percent. The riskafree rate of interest is 5 percent. The Sharpe ratio for your portfoiio is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts