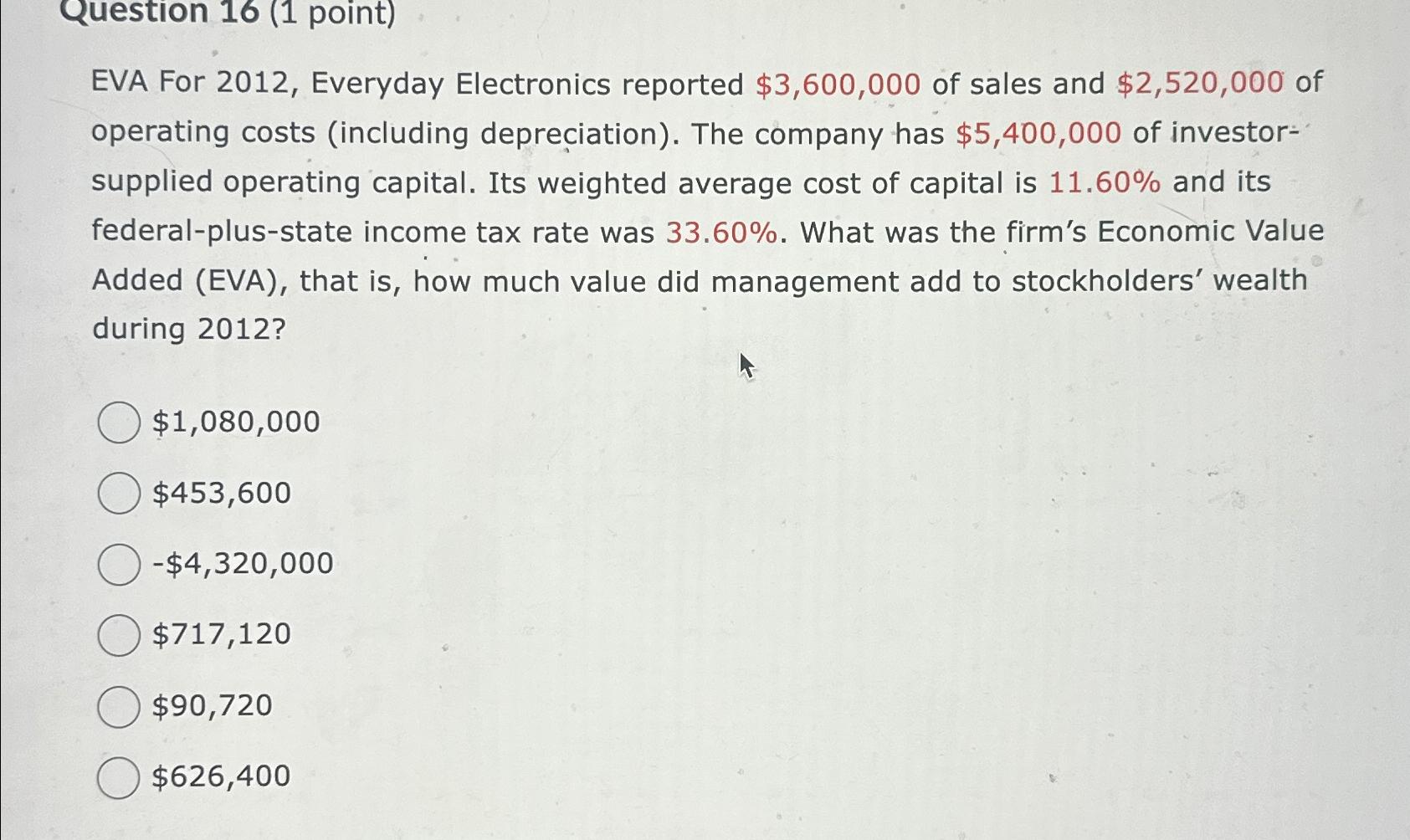

Question: Question 16 (1 point) EVA For 2012, Everyday Electronics reported $3,600,000 of sales and $2,520,000 of operating costs (including depreciation). The company has $5,400,000 of

Question 16 (1 point)\ EVA For 2012, Everyday Electronics reported

$3,600,000of sales and

$2,520,000of operating costs (including depreciation). The company has

$5,400,000of investorsupplied operating capital. Its weighted average cost of capital is

11.60%and its federal-plus-state income tax rate was

33.60%. What was the firm's Economic Value Added (EVA), that is, how much value did management add to stockholders' wealth during 2012?\

$1,080,000\

$453,600\

-$4,320,000\

$717,120\

$90,720\

$626,400

EVA For 2012, Everyday Electronics reported $3,600,000 of sales and $2,520,000 of operating costs (including depreciation). The company has $5,400,000 of investorsupplied operating capital. Its weighted average cost of capital is 11.60% and its federal-plus-state income tax rate was 33.60%. What was the firm's Economic Value Added (EVA), that is, how much value did management add to stockholders' wealth during 2012? $1,080,000 $453,600 $4,320,000 $717,120 $90,720 $626,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts