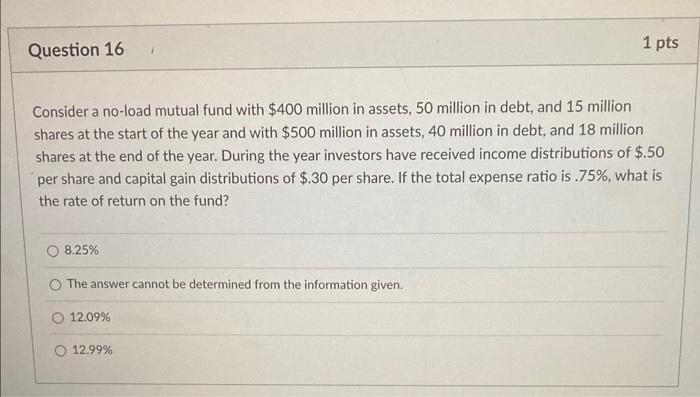

Question: Question 16 1 pts 4 Consider a no-load mutual fund with $400 million in assets, 50 million in debt, and 15 million shares at the

Question 16 1 pts 4 Consider a no-load mutual fund with $400 million in assets, 50 million in debt, and 15 million shares at the start of the year and with $500 million in assets, 40 million in debt, and 18 million shares at the end of the year. During the year investors have received income distributions of $.50 per share and capital gain distributions of $.30 per share. If the total expense ratio is .75%, what is the rate of return on the fund? 8.25% The answer cannot be determined from the information given. O 12.09% 12.99%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts