Question: Question 16 12.5 pts (CHAPTER 10) A large grocery store chain is considering paying $256,000 for new store equipment. Under MACRS depreciation system, this equipment

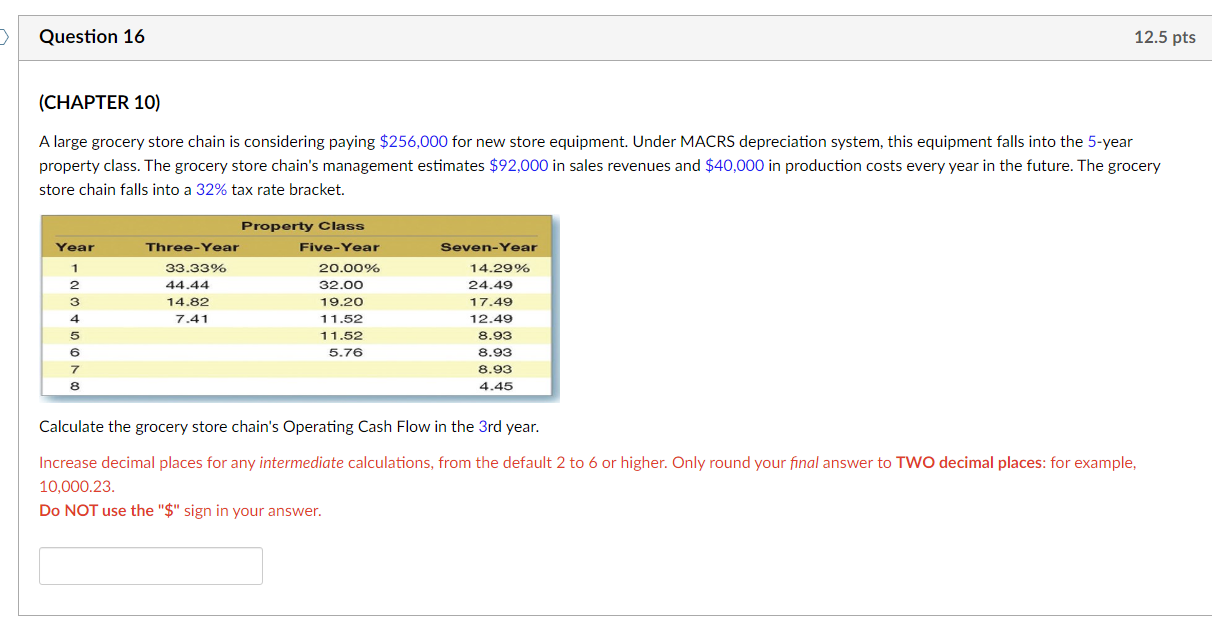

Question 16 12.5 pts (CHAPTER 10) A large grocery store chain is considering paying $256,000 for new store equipment. Under MACRS depreciation system, this equipment falls into the 5-year property class. The grocery store chain's management estimates $92,000 in sales revenues and $40,000 in production costs every year in the future. The grocery store chain falls into a 32% tax rate bracket. Year 1 2 3 Property Class Three-Year Five-Year 33.33% 20.00% 44.44 32.00 14.82 19.20 7.41 11.52 11.52 5.76 Seven-Year 14.29% 24.49 17.49 12.49 8.93 4 5 6 7 8 8.93 8.93 4.45 Calculate the grocery store chain's Operating Cash Flow in the 3rd year. your final answer to TWO decimal aces: for example, Increase decimal places for any intermediate calculations, from the default 2 to 6 or higher. Only 10,000.23. Do NOT use the "$" sign in your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts