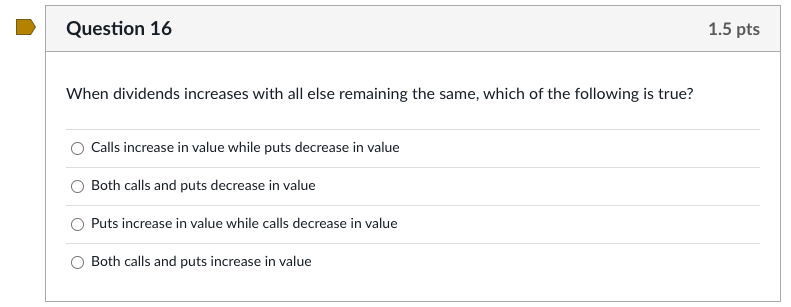

Question: Question 16 1.5 pts When dividends increases with all else remaining the same, which of the following is true? Calls increase in value while puts

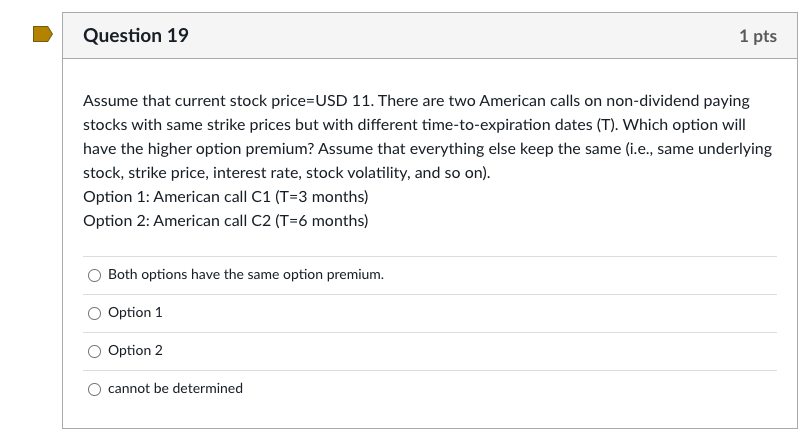

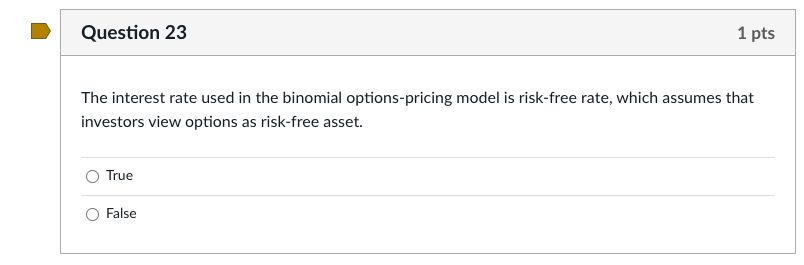

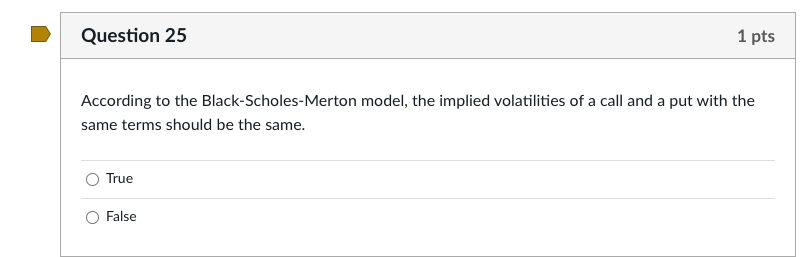

Question 16 1.5 pts When dividends increases with all else remaining the same, which of the following is true? Calls increase in value while puts decrease in value Both calls and puts decrease in value Puts increase in value while calls decrease in value Both calls and puts increase in value Question 19 1 pts Assume that current stock price=USD 11. There are two American calls on non-dividend paying stocks with same strike prices but with different time-to-expiration dates (T). Which option will have the higher option premium? Assume that everything else keep the same (i.e., same underlying stock, strike price, interest rate, stock volatility, and so on). Option 1: American call C1 (T=3 months) Option 2: American call C2 (T=6 months) Both options have the same option premium. O Option 1 Option 2 cannot be determined Question 23 1 pts The interest rate used in the binomial options-pricing model is risk-free rate, which assumes that investors view options as risk-free asset. True False Question 25 1 pts According to the Black-Scholes-Merton model, the implied volatilities of a call and a put with the same terms should be the same. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts