Question: Question 16 (2 points) The partnership between risk control and the claims function works both ways. In what way does the claims department enable risk

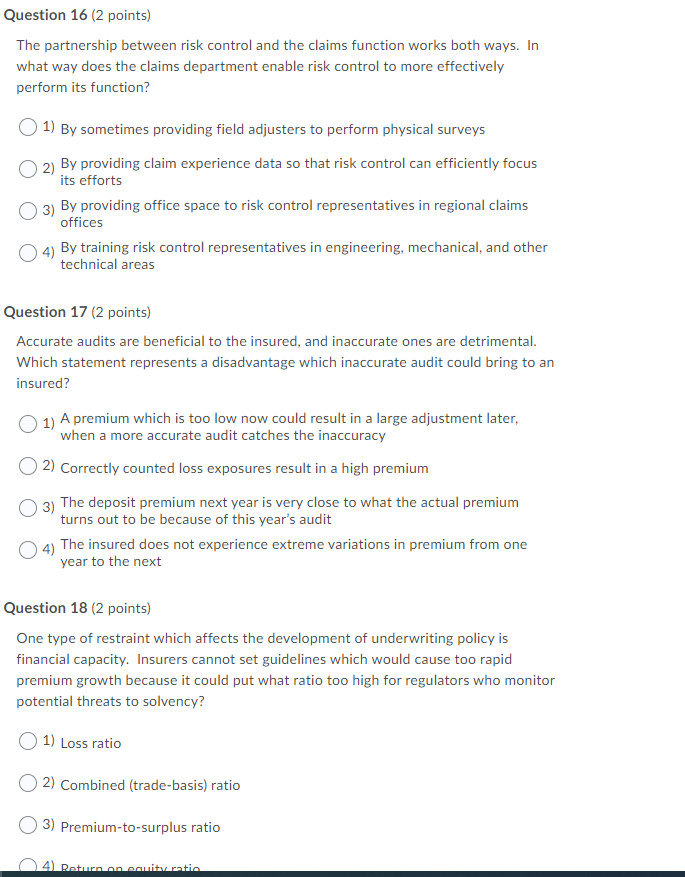

Question 16 (2 points) The partnership between risk control and the claims function works both ways. In what way does the claims department enable risk control to more effectively perform its function? 1) By sometimes providing field adjusters to perform physical surveys 2) By providing claim experience data so that risk control can efficiently focus its efforts 3) By providing office space to risk control representatives in regional claims offices 4) By training risk control representatives in engineering, mechanical, and other technical areas Question 17 (2 points) Accurate audits are beneficial to the insured, and inaccurate ones are detrimental. Which statement represents a disadvantage which inaccurate audit could bring to an insured? 1) A premium which is too low now could result in a large adjustment later, when a more accurate audit catches the inaccuracy 2) Correctly counted loss exposures result in a high premium 3) The deposit premium next year is very close to what the actual premium turns out to be because of this year's audit 4) The insured does not experience extreme variations in premium from one year to the next Question 18 (2 points) One type of restraint which affects the development of underwriting policy is financial capacity. Insurers cannot set guidelines which would cause too rapid premium growth because it could put what ratio too high for regulators who monitor potential threats to solvency? 1) Loss ratio 2) Combined (trade-basis) ratio 3) Premium-to-surplus ratio 4 Return on eauitvratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts