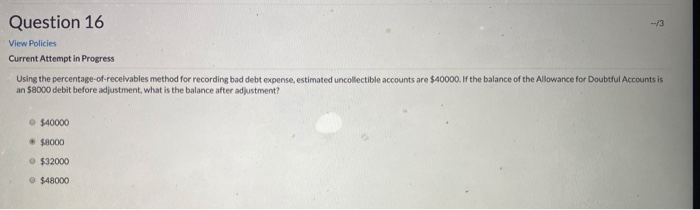

Question: Question 16 --/3 View Policies Current Attempt in Progress Using the percentage-of-receivables method for recording bad debt expense, estimated uncollectible accounts are $40000. If the

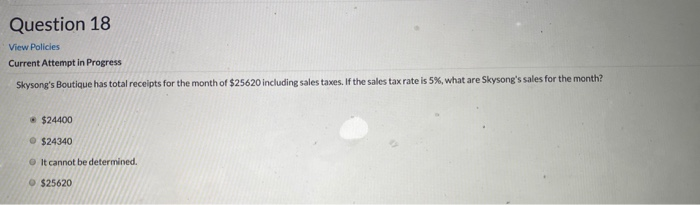

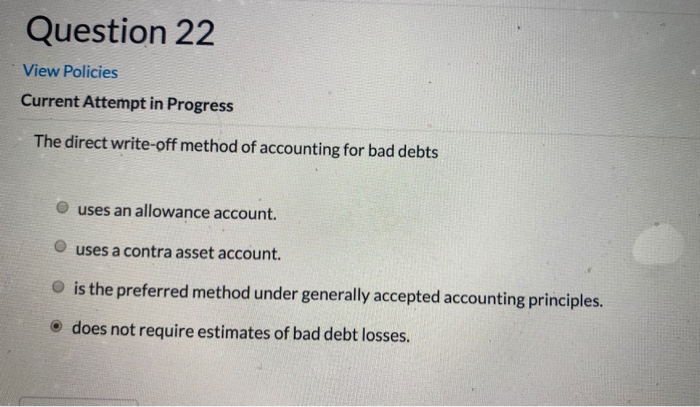

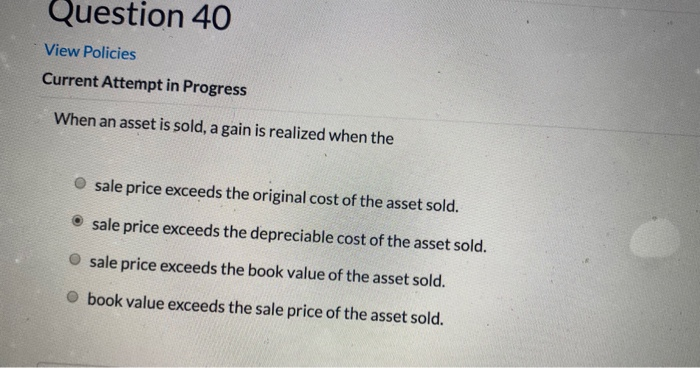

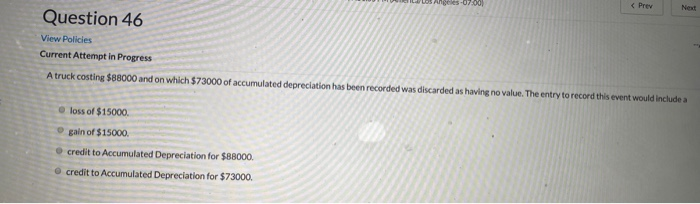

Question 16 --/3 View Policies Current Attempt in Progress Using the percentage-of-receivables method for recording bad debt expense, estimated uncollectible accounts are $40000. If the balance of the Allowance for Doubtful Accounts is an $8000 debit before adjustment, what is the balance after adjustment? $40000 $8000 $32000 $48000 Question 18 View Policies Current Attempt in Progress Skysong's Boutique has total receipts for the month of $25620 including sales taxes. If the sales tax rate is 5%, what are Skysong's sales for the month? $24400 $24340 It cannot be determined. $25620 Question 22 View Policies Current Attempt in Progress The direct write-off method of accounting for bad debts uses an allowance account. uses a contra asset account. is the preferred method under generally accepted accounting principles. does not require estimates of bad debt losses. Question 40 View Policies Current Attempt in Progress When an asset is sold, a gain is realized when the sale price exceeds the original cost of the asset sold. sale price exceeds the depreciable cost of the asset sold. sale price exceeds the book value of the asset sold. book value exceeds the sale price of the asset sold. -07:00)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts