Question: Question 16 (5 points) If ROA (return on assets)-22% and if ROE (return on equity)-36%, what is the firm's debt ratio (i.e., Debt/Total assets). Assume,

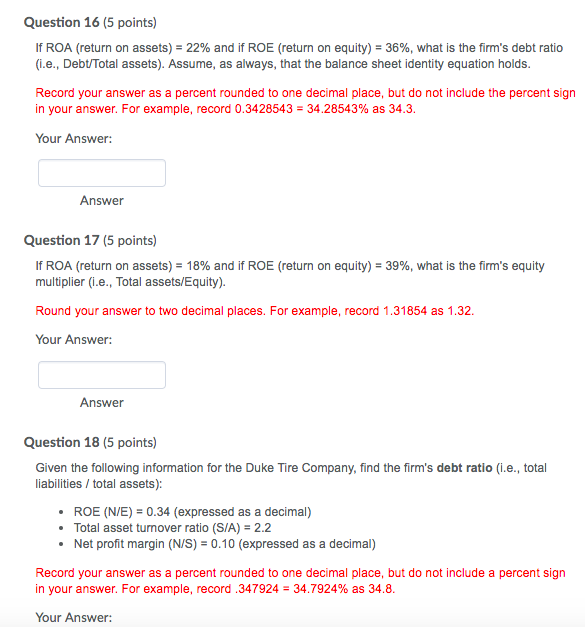

Question 16 (5 points) If ROA (return on assets)-22% and if ROE (return on equity)-36%, what is the firm's debt ratio (i.e., Debt/Total assets). Assume, as always, that the balance sheet identity equation holds. Record your answer as a percent rounded to one decimal place, but do not include the percent sign in your answer. For example, record 0.3428543-34.28543% as 34.3. Your Answer: Answer Question 17 (5 points) If ROA (return on assets,-18% and if ROE (return on equity) 39%, what is the firm's equity multiplier (i.e., Total assets/Equity). Round your answer to two decimal places. For example, record 1.31854 as 1.32. Your Answer: Answer Question 18 (5 points) iaba ne todo in ioaonthe Due ethemto(e, tolal liabilities/total assets): ROE (N/E)0.34 (expressed as a decimal) Total asset turnover ratio (SIA) 2.2 Net profit margin (N/S) 0.10 (expressed as a decimal) Record your answer as a percent rounded to one decimal place, but do not include a percent sign in your answer. For example, record .347924-34.7924% as 34.8. Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts