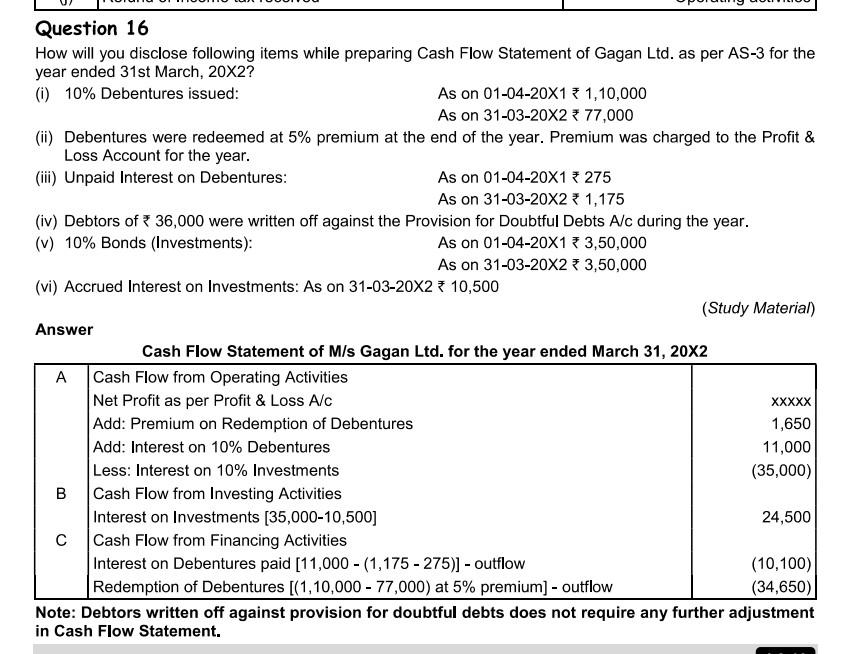

Question: Question 16 How will you disclose following items while preparing Cash Flow Statement of Gagan Ltd. as per AS-3 for the year ended 31st March,

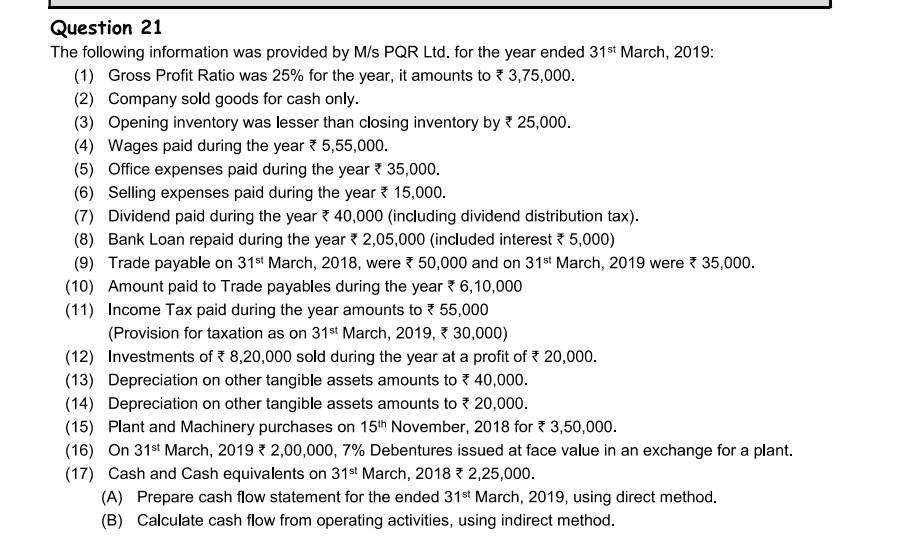

Question 16 How will you disclose following items while preparing Cash Flow Statement of Gagan Ltd. as per AS-3 for the year ended 31st March, 20X2? (i) \10 Debentures issued: As on \\( 01-04-20 \\times 1 1,10,000 \\) As on 31-03-20X2 77,000 (ii) Debentures were redeemed at \5 premium at the end of the year. Premium was charged to the Profit \\& Loss Account for the year. (iii) Unpaid Interest on Debentures: \\( \\quad \\) As on 01-04-20X1 275 As on 31-03-20X2 1,175 (iv) Debtors of 36,000 were written off against the Provision for Doubtful Debts A/c during the year. (v) \10 Bonds (Investments): As on \\( 01-04-20 \\times 1 3,50,000 \\) As on \\( 31-03-20 \\times 2 3,50,000 \\) (vi) Accrued Interest on Investments: As on 31-03-20X2 10,500 (Study Material) The following information was provided by M/s PQR Ltd. for the year ended \\( 31^{\\text {st }} \\) March, 2019: (1) Gross Profit Ratio was \25 for the year, it amounts to \\( 3,75,000 \\). (2) Company sold goods for cash only. (3) Opening inventory was lesser than closing inventory by 25,000 . (4) Wages paid during the year 5,55,000. (5) Office expenses paid during the year 35,000 . (6) Selling expenses paid during the year 15,000 . (7) Dividend paid during the year 40,000 (including dividend distribution tax). (8) Bank Loan repaid during the year 2,05,000 (included interest 5,000) (9) Trade payable on \\( 31^{\\text {st }} \\) March, 2018, were 50,000 and on \\( 31^{\\text {st }} \\) March, 2019 were \\( 35,000 \\). (10) Amount paid to Trade payables during the year \\( 6,10,000 \\) (11) Income Tax paid during the year amounts to 55,000 (Provision for taxation as on \\( 31^{\\text {st }} \\) March, 2019, 30,000 ) (12) Investments of \\( 8,20,000 \\) sold during the year at a profit of 20,000 . (13) Depreciation on other tangible assets amounts to 40,000 . (14) Depreciation on other tangible assets amounts to 20,000 . (15) Plant and Machinery purchases on \\( 15^{\\text {th }} \\) November, 2018 for \\( 3,50,000 \\). (16) On \\( 31^{\\text {st }} \\) March, \20192,00,000,7 Debentures issued at face value in an exchange for a plant. (17) Cash and Cash equivalents on \\( 31^{\\text {st }} \\) March, 2018 2,25,000. (A) Prepare cash flow statement for the ended 31 \\( 1^{\\text {st }} \\) March, 2019, using direct method. (B) Calculate cash flow from operating activities, using indirect method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts