Question: Question 16 In applying the Section 1231 look back rule, a Section 1231 loss in the preceding five year period would cause: The taxpayer to

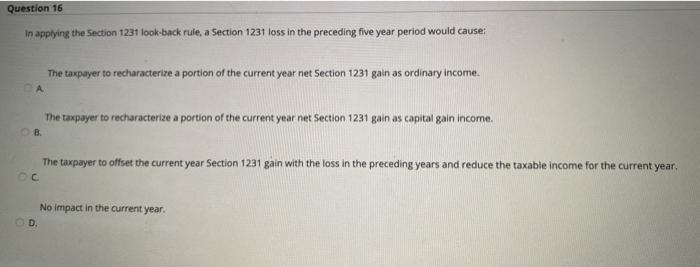

Question 16 In applying the Section 1231 look back rule, a Section 1231 loss in the preceding five year period would cause: The taxpayer to recharacterize a portion of the current year net Section 1231 gain as ordinary income. The taxpayer to recharacterize a portion of the current year net Section 1231 gain as capital gain income The taxpayer to offset the current year Section 1231 gain with the loss in the preceding years and reduce the taxable income for the current year. No impact in the current year. D. Question 16 In applying the Section 1231 look back rule, a Section 1231 loss in the preceding five year period would cause: The taxpayer to recharacterize a portion of the current year net Section 1231 gain as ordinary income. The taxpayer to recharacterize a portion of the current year net Section 1231 gain as capital gain income The taxpayer to offset the current year Section 1231 gain with the loss in the preceding years and reduce the taxable income for the current year. No impact in the current year. D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts