Question: Question 16. Need excel with the formula and an explanation of the formula.(=formulatext) Thanks What is the compound rate of interest being offered in the

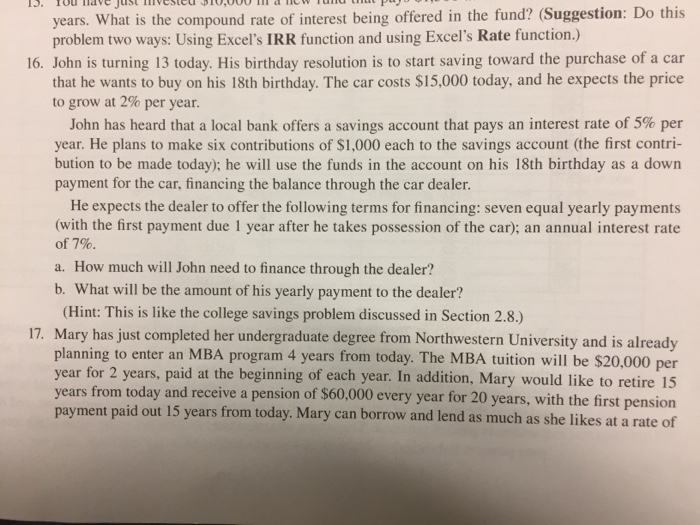

What is the compound rate of interest being offered in the fund? (Suggestion: Do this years. problem two ways: Using Excel's IRR function and using Excel's Rate function.) 16. John is turning 13 today. His birthday resolution is to start saving toward the purchase of a car that he wants to buy on his 18th birthday. The car costs $15,000 today, and he expects the price to grow at 2% per year John has heard that a local bank offers a savings account that pays an interest rate of 5% per year. He plans to make six contributions of $1,000 each to the savings account (the first contri- bution to be made today); he will use the funds in the account on his 18th birthday as a down payment for the car, financing the balance through the car dealer He expects the dealer to offer the following terms for financing: seven equal yearly payments with the first payment due 1 year after he takes possession of the car); an annual interest rate of 7% How much will John need to finance through the dealer? b. What will be the amount of his yearly payment to the dealer? (Hint: This is like the college savings problem discussed in Section 2.8.) Mary has just completed her undergraduate degree from Northwestern University and is already planning to enter an MBA program 4 years from today. The MBA tuition will be $20,000 per year for 2 years, paid at the beginning of each year. In addition, Mary would like to retire 15 7. every year for 20 years, with the first pension a rate of payment paid out 15 years from today. Mary can borrow and lend as much as she likes at

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts