Question: QUESTION 16 Oranges Inc. has a zero coupon bond maturing in exactly 10 years. The bond has a face value of $1,000, price of $553.67,

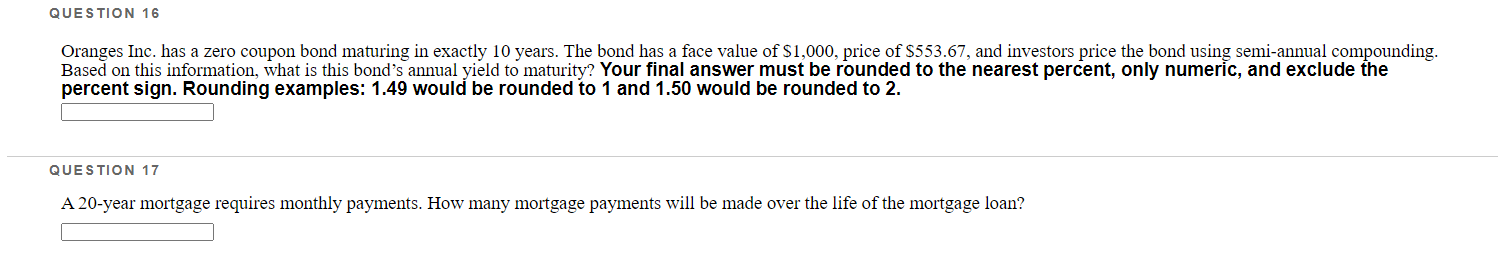

QUESTION 16 Oranges Inc. has a zero coupon bond maturing in exactly 10 years. The bond has a face value of $1,000, price of $553.67, and investors price the bond using semi-annual compounding. Based on this information, what is this bond's annual yield to maturity? Your final answer must be rounded to the nearest percent, only numeric, and exclude the percent sign. Rounding examples: 1.49 would be rounded to 1 and 1.50 would be rounded to 2. QUESTION 17 A 20-year mortgage requires monthly payments. How many mortgage payments will be made over the life of the mortgage loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts