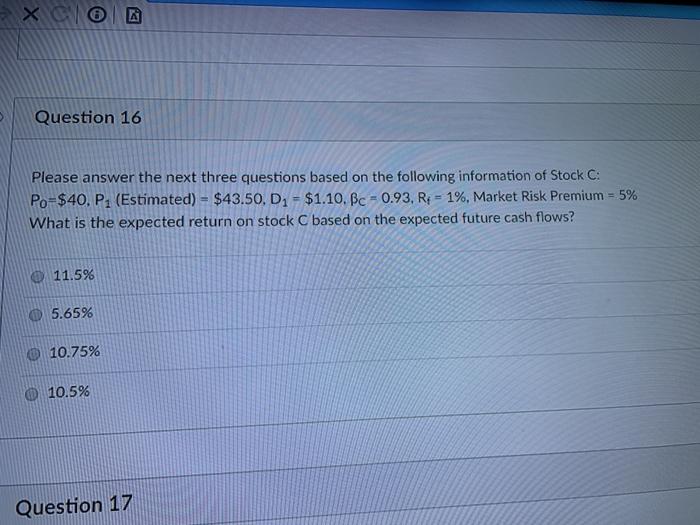

Question: Question 16 Please answer the next three questions based on the following information of Stock C: Po=$40, P1 (Estimated) = $43.50, D. - $1.10. Bc

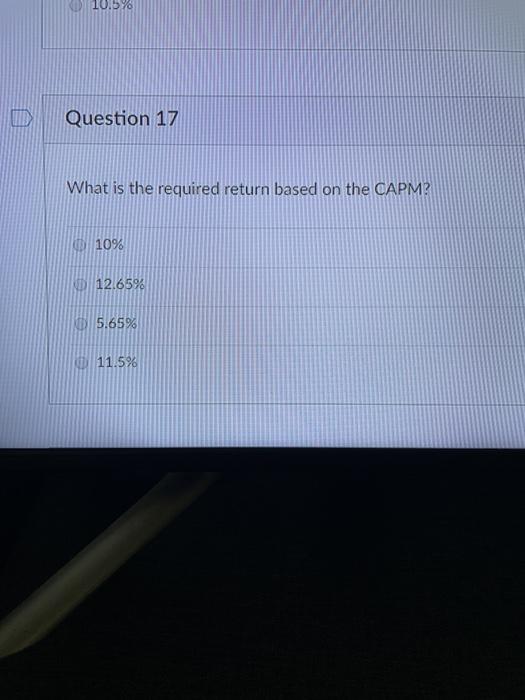

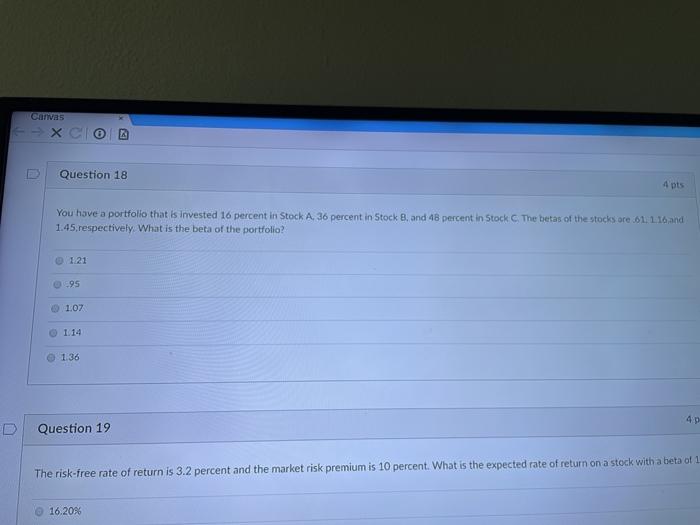

Question 16 Please answer the next three questions based on the following information of Stock C: Po=$40, P1 (Estimated) = $43.50, D. - $1.10. Bc = 0.93, R = 1%. Market Risk Premium = 5% What is the expected return on stock C based on the expected future cash flows? 11.5% 5.65% 10.75% 10.5% Question 17 10.5 48 UITD Question 17 What is the required return based on the CAPM? 10% IND 12.65% ND5.65% 11.5% Canvas Question 18 4 pts You have a portfolio that is invested 16 percent in Stock A, 36 percent in Stock 8 and 48 percent in Stock C The betas of the stocks are 61.1.16 and 1.45, respectively. What is the beta of the portfolio? 1.21 95 1.07 1.14 136 Question 19 The risk-free rate of return is 3.2 percent and the market risk premium is 10 percent. What is the expected rate of return on a stock with a beta of 1 16.20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts