Question: QUESTION 16 PPP Widget Store had a balance in the Accounts Receivable account of $760,000 at the beginning of the year and a balance of

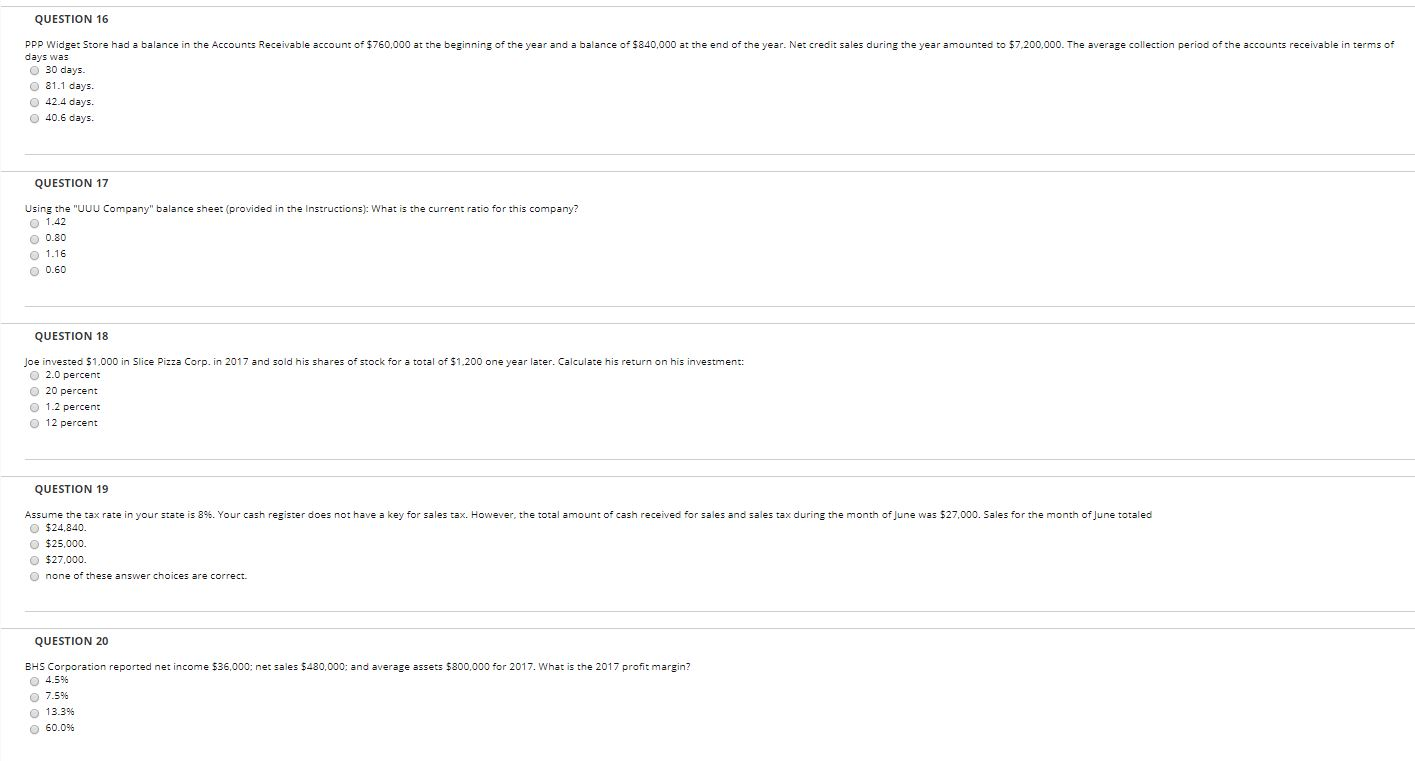

QUESTION 16 PPP Widget Store had a balance in the Accounts Receivable account of $760,000 at the beginning of the year and a balance of 5840,000 at the end of the year. Net credit sales during the year amounted to $7,200,000. The average collection period of the accounts receivable in terms of days was 30 days. 81.1 days. 42.4 days. 40.6 days. QUESTION 17 Using the "UUU Company" balance sheet (provided in the Instructions): What is the current ratio for this company? 1.42 0.80 1.16 0.60 QUESTION 18 Joe invested $1,000 in Slice Pizza Corp. in 2017 and sold his shares of stock for a total of $1.200 one year later. Calculate his return on his investment: 2.0 percent 20 percent 1.2 percent 12 percent QUESTION 19 Assume the tax rate in your state is 8%. Your cash register does not have a key for sales tax. However, the total amount of cash received for sales and sales tax during the month of June was $27,000. Sales for the month of June totaled $24.840. $25,000. $27,000. none of these answer choices are correct. QUESTION 20 BHS Corporation reported net income $36,000: net sales $480,000: and average assets $800,000 for 2017. What is the 2017 profit margin? 4.596 7.59 13.39 60.0% QUESTION 16 PPP Widget Store had a balance in the Accounts Receivable account of $760,000 at the beginning of the year and a balance of 5840,000 at the end of the year. Net credit sales during the year amounted to $7,200,000. The average collection period of the accounts receivable in terms of days was 30 days. 81.1 days. 42.4 days. 40.6 days. QUESTION 17 Using the "UUU Company" balance sheet (provided in the Instructions): What is the current ratio for this company? 1.42 0.80 1.16 0.60 QUESTION 18 Joe invested $1,000 in Slice Pizza Corp. in 2017 and sold his shares of stock for a total of $1.200 one year later. Calculate his return on his investment: 2.0 percent 20 percent 1.2 percent 12 percent QUESTION 19 Assume the tax rate in your state is 8%. Your cash register does not have a key for sales tax. However, the total amount of cash received for sales and sales tax during the month of June was $27,000. Sales for the month of June totaled $24.840. $25,000. $27,000. none of these answer choices are correct. QUESTION 20 BHS Corporation reported net income $36,000: net sales $480,000: and average assets $800,000 for 2017. What is the 2017 profit margin? 4.596 7.59 13.39 60.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts