Question: Question 16 There are two components that make up the selling price of a bond. Determine the selling price of a $750,000, ten-year, 10% (pays

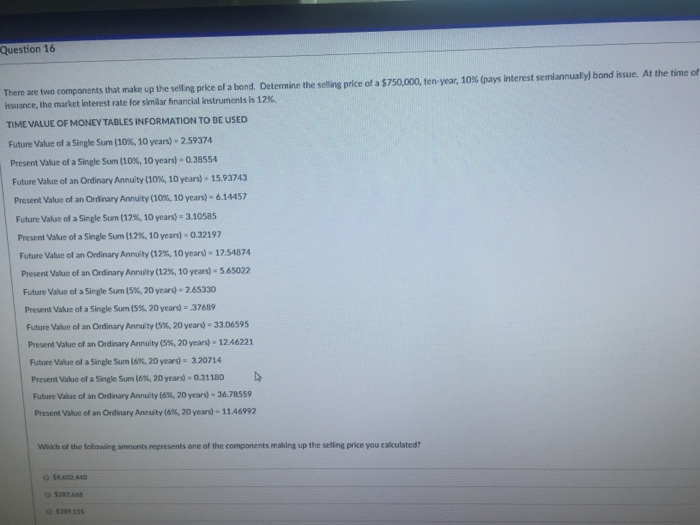

Question 16 There are two components that make up the selling price of a bond. Determine the selling price of a $750,000, ten-year, 10% (pays interest semiannually bond issue. At the time of Issuance, the market interest rate for similar financial instruments is 12% TIME VALUE OF MONEY TABLES INFORMATION TO BE USED Future Value of a Single Sum (10%, 10 years) - 2.59374 Present Value of a Single Sum (10%, 10 years) - 0.38554 Future Value of an ordinary Annuity (10%, 10 years) - 15.93743 Present Value of an ordinary Annuity (10%, 10 years) - 6.14457 Future Value of a Single Sum (12%, 10 years) = 3.10585 Present Value of a Single Sum (12%, 10 years) - 0.32197 Future Value of an ordinary Annuity (12%, 10 years) - 17.54874 Present Value of an ordinary Annuity (12%, 10 years) - 565022 Future Value of a Single Sum (5%, 20 years) - 2.65330 Present Value of a Single Sum (5%, 20 years) = 37689 Future Value of an ordinary Annuity (5%, 20 years) - 33,06595 Present Value of an ordinary Annuity (5%, 20 years) - 12.46221 Future Value of a Single Sum (8%, 20 years) = 3.20714 Present Value of a Single Sum (6%, 20 years) - 0.31180 Future Value of an ordinary Annuity (6%, 20 years) - 36.78559 Present Value of an ordinary Annuity (6%, 20 years) - 1146992 Which of the following amounts represents one of the components making up the selling price you calculated? 0 58.609.440 $287.668

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts