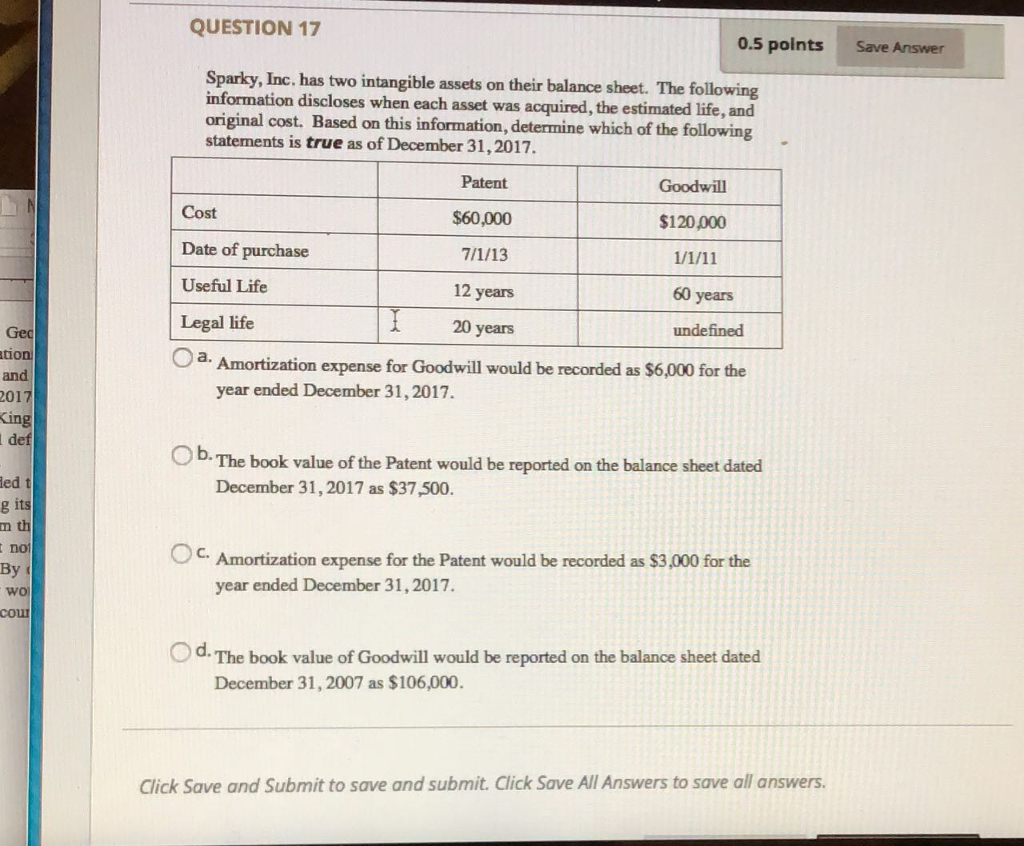

Question: QUESTION 17 0.5 points Save Answer Sparky, Inc. has two intangible assets on their balance sheet. The following information discloses when each asset was acquired,

QUESTION 17 0.5 points Save Answer Sparky, Inc. has two intangible assets on their balance sheet. The following information discloses when each asset was acquired, the estimated life, and original cost. Based on this information, determine which of the following statements is true as of December 31,2017. Patent Cost Date of purchase Useful Life Legal life Oa. Amortization expense for Goodwill would be recorded as $6,000 for the $60,000 $120,000 12 years 60 years 20 years undefined Geo tion and 017 King def year ended December 31,2017. b. The book value of the Patent would be reported on the balance sheet dated ed t its m th not By ( wo cour December 31,2017 as $37,500. Amortization expense for the Patent would be recorded as $3,000 for the year ended December 31,2017. O d.The book value of Goodwill would be reported on the balance sheet dated December 31, 2007 as $106,000. Click Save and Submit to save and submit. Click Save All Answers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts