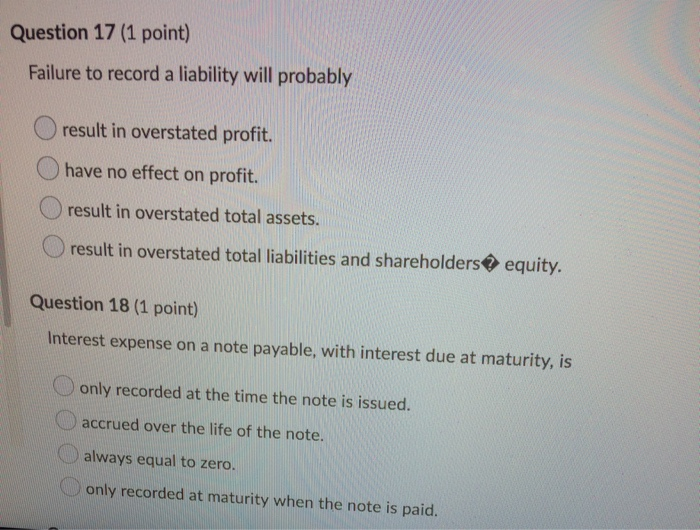

Question: Question 17 (1 point) Failure to record a liability will probably result in overstated profit. have no effect on profit. result in overstated total assets.

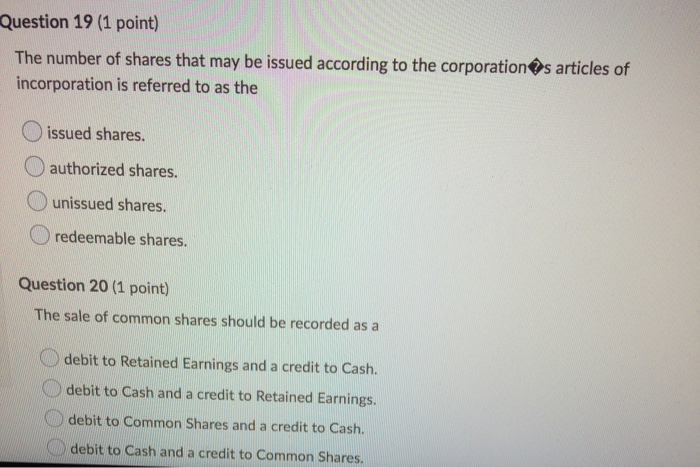

Question 17 (1 point) Failure to record a liability will probably result in overstated profit. have no effect on profit. result in overstated total assets. result in overstated total liabilities and shareholders equity. Question 18 (1 point) Interest expense on a note payable, with interest due at maturity, is only recorded at the time the note is issued. accrued over the life of the note. always equal to zero. only recorded at maturity when the note is paid. Question 19 (1 point) The number of shares that may be issued according to the corporations articles of incorporation is referred to as the issued shares. authorized shares. unissued shares. redeemable shares. Question 20 (1 point) The sale of common shares should be recorded as a debit to Retained Earnings and a credit to Cash. debit to Cash and a credit to Retained Earnings. debit to Common Shares and a credit to Cash. debit to Cash and a credit to Common Shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts