Question: QUESTION 17 1 points Save Answer Perry Inc.'s bonds currently sell for $1,150. They have a 6-year maturity, an annual coupon of $85, and a

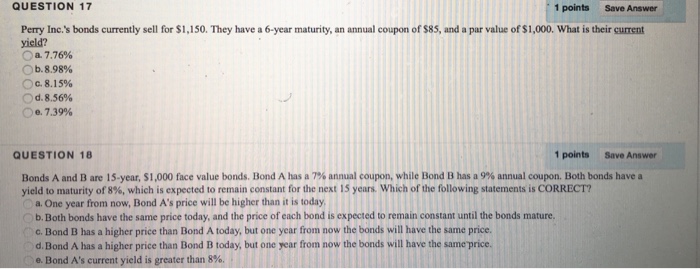

QUESTION 17 1 points Save Answer Perry Inc.'s bonds currently sell for $1,150. They have a 6-year maturity, an annual coupon of $85, and a par value of $1,000. What is their current yield? 0 a 7.76% b. 8.98% 0#8.15% 0 d. 8.56% Oe. 7.39% QUESTION 18 1 points Save Answer Bands A and B are 15-year, S 1,000 face value bonds Bond A has a 7% annual coupon, while Bond B has a 9% annual coupon. Both bonds have a yield to maturity of 8% which is expected to remain constant for the next 15 years which of the following statements is CORRECT? a One year from now, Bond A's price will be higher than it is today b. Both bonds have the same price today, and the price of each bond is expected to remain constant until the bonds mature. c. Bond B has a higher price than Bond A today, but one year from now the bonds will have the same price. d. Bond A has a higher price than Bond B today, but one year from now the bonds will have the same price e. Bond A's current yield is greater than 8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts