Question: Question 17 (10 points) Saved The current spot exchange rate is $1.55 = 1.00 and the three-month forward rate is $1.60 = 1.00. Consider a

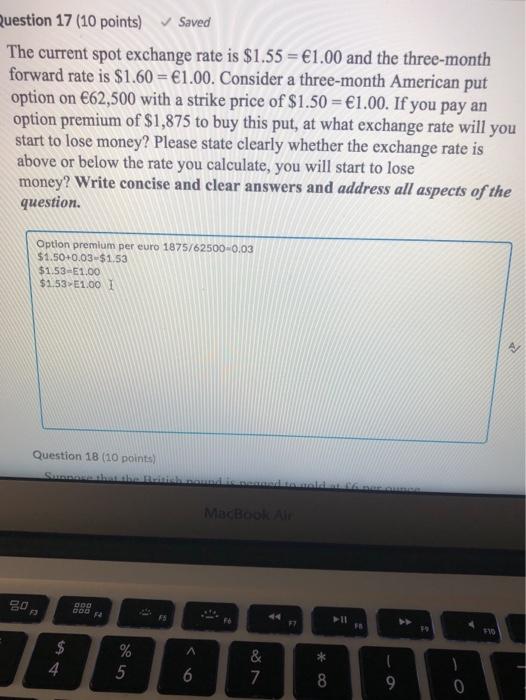

Question 17 (10 points) Saved The current spot exchange rate is $1.55 = 1.00 and the three-month forward rate is $1.60 = 1.00. Consider a three-month American put option on 62,500 with a strike price of $1.50 = 1.00. If you pay an option premium of $1,875 to buy this put, at what exchange rate will you start to lose money? Please state clearly whether the exchange rate is above or below the rate you calculate, you will start to lose money? Write concise and clear answers and address all aspects of the question. Option premium per euro 1875/62500-0,03 $1.50+0.03-$1.53 $1.53-51.00 $1,53E1.00 1 Question 18 (10 points) MacBook DOO A 2 $ 4 % 5 * ON 6 & 7 8 8 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts