Question: QUESTION 17 15 points Save Answer Founder owns 5,000,000 shares of common stock in Piper Corporation. Piper now needs to raise $3,000,000 to execute its

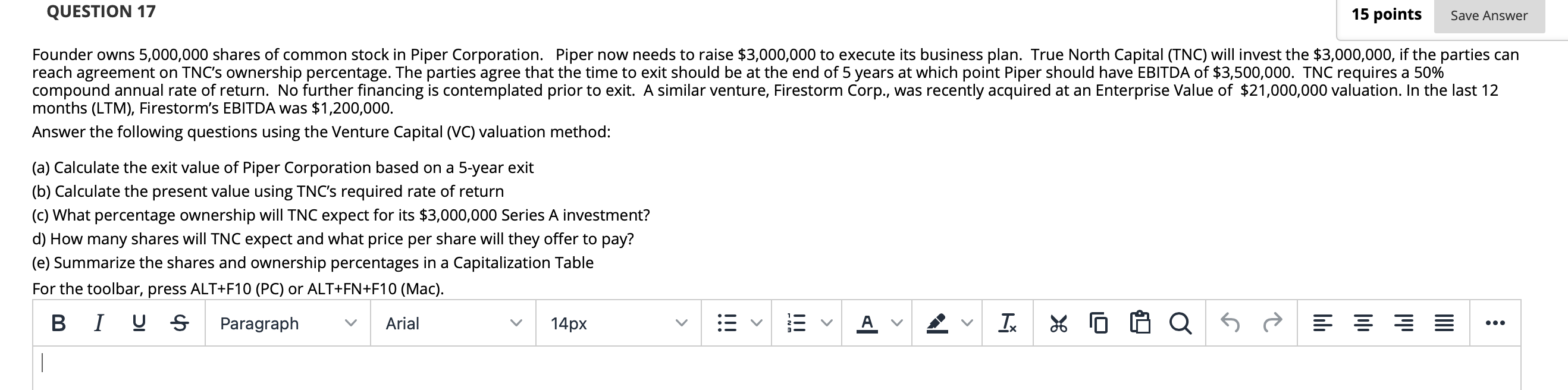

QUESTION 17 15 points Save Answer Founder owns 5,000,000 shares of common stock in Piper Corporation. Piper now needs to raise $3,000,000 to execute its business plan. True North Capital (TNC) will invest the $3,000,000, if the parties can reach agreement on TNC's ownership percentage. The parties agree that the time to exit should be at the end of 5 years at which point Piper should have EBITDA of $3,500,000. TNC requires a 50% compound annual rate of return. No further financing is contemplated prior to exit. A similar venture, Firestorm Corp., was recently acquired at an Enterprise Value of $21,000,000 valuation. In the last 12 months (LTM), Firestorm's EBITDA was $1,200,000. Answer the following questions using the Venture Capital (VC) valuation method: (a) Calculate the exit value of Piper Corporation based on a 5-year exit (b) Calculate the present value using TNC's required rate of return (c) What percentage ownership will TNC expect for its $3,000,000 Series A investment? d) How many shares will TNC expect and what price per share will they offer to pay? (e) Summarize the shares and ownership percentages in a Capitalization Table For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B I U S Paragraph Arial 14px III

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts