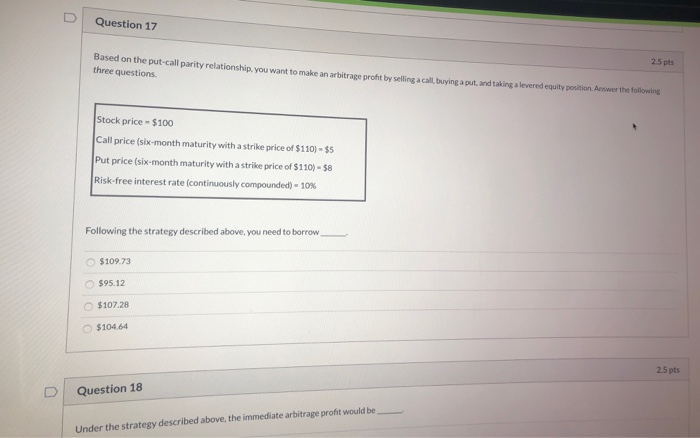

Question: Question 17 25 pts Based on the put-call party relationship. you want to make an arbitrage profit by selling a call buying a put, and

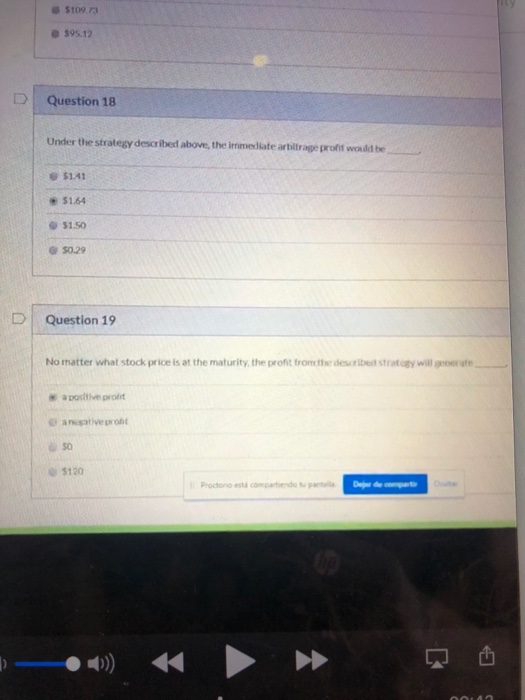

Question 17 25 pts Based on the put-call party relationship. you want to make an arbitrage profit by selling a call buying a put, and taking a levered equity portion three questions the follow Stock price $100 Call price (six-month maturity with a strike price of $110) - $5 Put price (six-month maturity with a strike price of $110) - $8 Risk-free interest rate continuously compounded) - 10% Following the strategy described above, you need to borrow $109.73 595.12 $107.28 $10464 25 pts D Question 18 strategy described above, the immediate arbitrage profit would be 5109.73 595.12 D Question 18 Under the strategy described above, the immediate arbitrage profit would be 5141 51.64 51.50 50.29 D Question 19 No matter what stock price is at the maturity, the profit from the described try will get positive pront negative pront 50 5120 1 Proctono est compartiendo tu partalla De departe *)))

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts