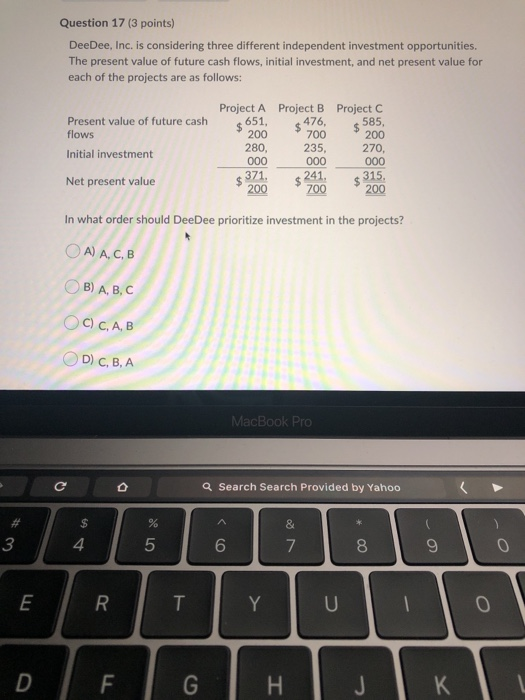

Question: Question 17 (3 points) DeeDee, Inc. is considering three different independent investment opportunities. The present value of future cash flows, initial investment, and net present

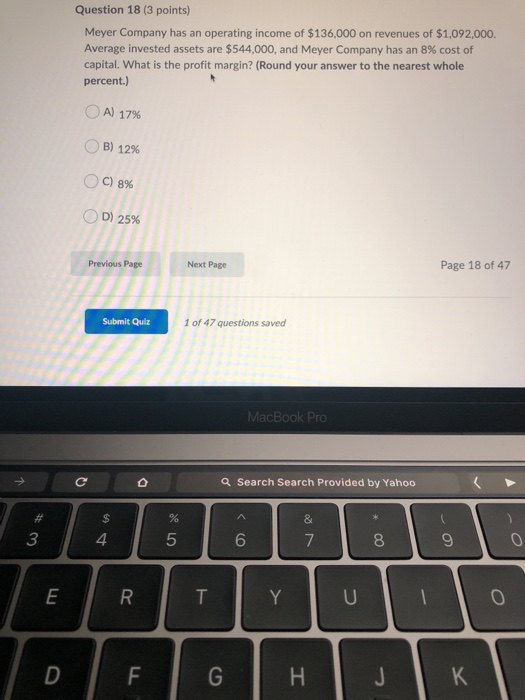

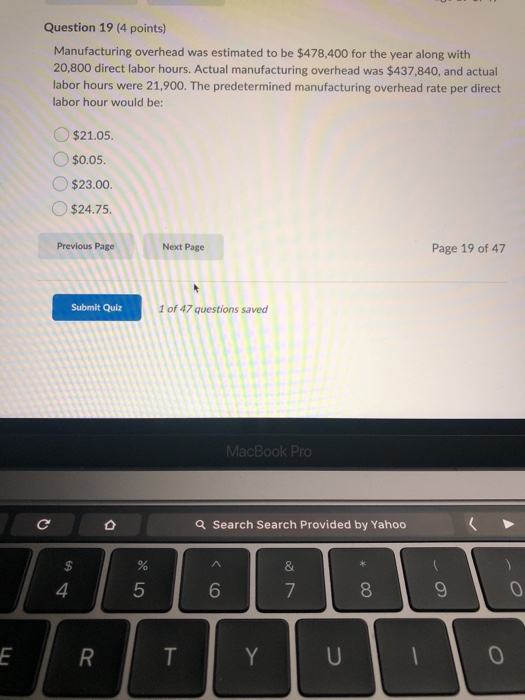

Question 17 (3 points) DeeDee, Inc. is considering three different independent investment opportunities. The present value of future cash flows, initial investment, and net present value for each of the projects are as follows: Project B 476, Project C 585, Present value of future cash flows Initial investment Project A 651, 200 280, 000 $ 700 $ 200 235, 000 270, 000 Net present value 371. $ 241. $315 200 700 200 In what order should DeeDee prioritize investment in the projects? O A) A, C, B B) A, B, C O C) C, A,B OD) C, B, A MacBook Pro Search Search Provided by Yahoo # w Question 18 (3 points) Meyer Company has an operating income of $136,000 on revenues of $1,092,000. Average invested assets are $544,000, and Meyer Company has an 8% cost of capital. What is the profit margin? (Round your answer to the nearest whole percent.) A) 17% OB) 12% C) 8% D) 25% Previous Page Next Page Page 18 of 47 Submit Quiz 1 of 47 questions saved MacBook Pro Ic o a Search Search Provided by Yahoo E Question 19 (4 points) Manufacturing overhead was estimated to be $478,400 for the year along with 20,800 direct labor hours. Actual manufacturing overhead was $437,840, and actual labor hours were 21,900. The predetermined manufacturing overhead rate per direct labor hour would be: $21.05. O $0.05. $23.00 Previous Next Page Page 19 of 47 Submit Quiz 1 of 47 questions saved MacBook Pro Q Search Search Provided by Yahoo S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts