Question: Question 17 8.57 pts Project Q has an initial cost of $257,412 and projected cash flows of $123,300 in Year 1 and $180,300 in Year

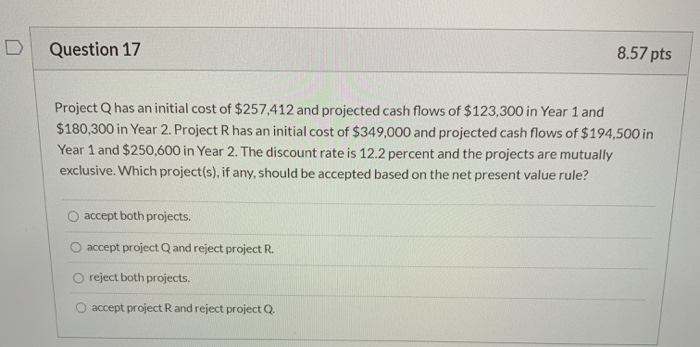

Question 17 8.57 pts Project Q has an initial cost of $257,412 and projected cash flows of $123,300 in Year 1 and $180,300 in Year 2. Project R has an initial cost of $349,000 and projected cash flows of $194,500 in Year 1 and $250,600 in Year 2. The discount rate is 12.2 percent and the projects are mutually exclusive. Which project(s), if any, should be accepted based on the net present value rule? accept both projects. accept project Q and reject project R. reject both projects. accept project Rand reject project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts