Question: Question 17 and 18 Question Completion Status: QUESTION 17 Assume that a speculator purchases a put option on British pounds (with a strike price of

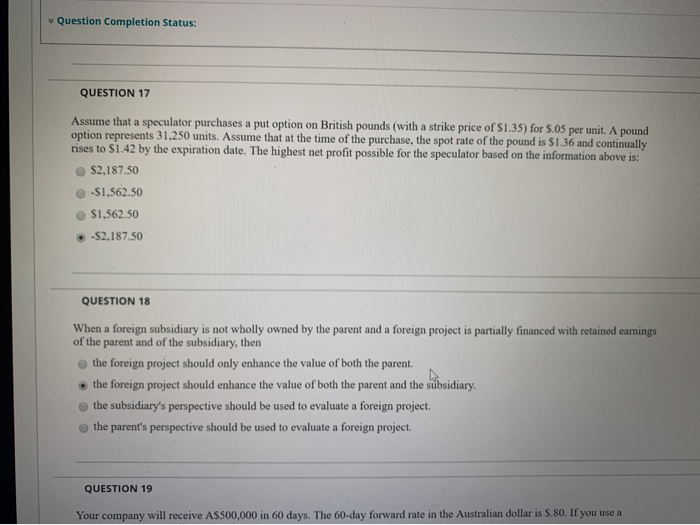

Question Completion Status: QUESTION 17 Assume that a speculator purchases a put option on British pounds (with a strike price of $1.35) for 5.05 per unit. A pound option represents 31.250 units. Assume that at the time of the purchase, the spot rate of the pound is $1.36 and continually rises to S1.42 by the expiration date. The highest net profit possible for the speculator based on the information above is: S2.187.50 -S1,562.50 $1,562.50 . -$2,187.50 QUESTION 18 When a foreign subsidiary is not wholly owned by the parent and a foreign project is partially financed with retained earings of the parent and of the subsidiary, then the foreign project should only enhance the value of both the parent. the foreign project should enhance the value of both the parent and the subsidiary. the subsidiary's perspective should be used to evaluate a foreign project. the parent's perspective should be used to evaluate a foreign project. QUESTION 19 Your company will receive A$500,000 in 60 days. The 60-day forward rate in the Australian dollar is 5.80. If you use a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts