Question: question 17 and 18 Question Completion Status: QUESTION 17 Consider a small cap value portfolio where the investment manager generates 0.22% of Carhartt alpha. The

question 17 and 18

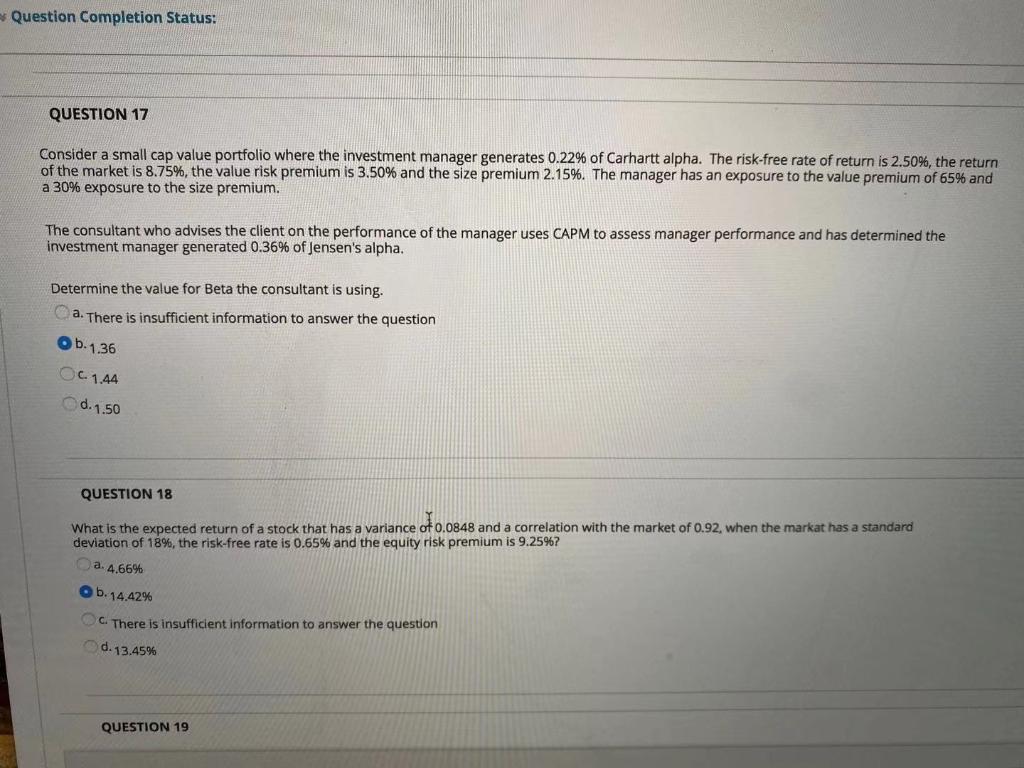

Question Completion Status: QUESTION 17 Consider a small cap value portfolio where the investment manager generates 0.22% of Carhartt alpha. The risk-free rate of return is 2.50%, the return of the market is 8.75%, the value risk premium is 3.50% and the size premium 2.15%. The manager has an exposure to the value premium of 65% and a 30% exposure to the size premium. The consultant who advises the client on the performance of the manager uses CAPM to assess manager performance and has determined the investment manager generated 0.36% of Jensen's alpha. Determine the value for Beta the consultant is using. a. There is insufficient information to answer the question OL 5.1.36 OC 1.44 d. 1.50 QUESTION 18 What is the expected return of a stock that has a variance of 0.0848 and a correlation with the market of 0.92, when the markat has a standard deviation of 18%, the risk-free rate is 0.65% and the equity risk premium is 9.25%? a. 4.66% Ob.14.42% C. There is insufficient information to answer the question d. 13.45% QUESTION 19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts