Question: Question 17 is only there for refrence. So its only 18 I want. QUESTION 17 Lucy bought a house that costs $200,000. Lucy will sell

Question 17 is only there for refrence. So its only 18 I want.

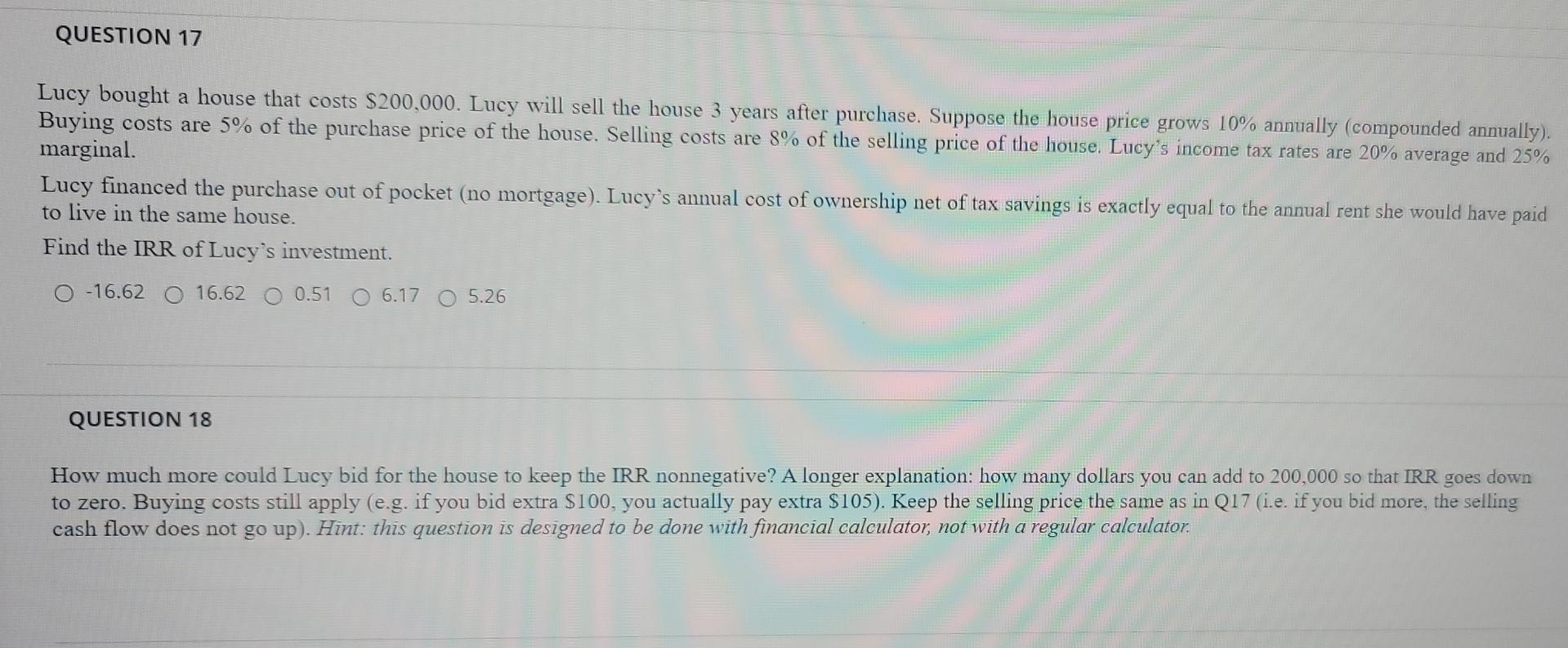

QUESTION 17 Lucy bought a house that costs $200,000. Lucy will sell the house 3 years after purchase. Suppose the house price grows 10% annually (compounded annually). Buying costs are 5% of the purchase price of the house. Selling costs are 8% of the selling price of the house. Lucy's income tax rates are 20% average and 25% marginal Lucy financed the purchase out of pocket (no mortgage). Lucy's annual cost of ownership net of tax savings is exactly equal to the annual rent she would have paid to live in the same house. Find the IRR of Lucy's investment. O-16.62 O 16.62 O 0.51 O 6.17 O 5.26 QUESTION 18 How much more could Lucy bid for the house to keep the IRR nonnegative? A longer explanation: how many dollars you can add to 200,000 so that IRR goes down to zero. Buying costs still apply (e.g. if you bid extra $100. you actually pay extra $105). Keep the selling price the same as in Q17 (i.e. if you bid more, the selling cash flow does not go up). Hint: this question is designed to be done with financial calculator, not with a regular calculator. QUESTION 17 Lucy bought a house that costs $200,000. Lucy will sell the house 3 years after purchase. Suppose the house price grows 10% annually (compounded annually). Buying costs are 5% of the purchase price of the house. Selling costs are 8% of the selling price of the house. Lucy's income tax rates are 20% average and 25% marginal Lucy financed the purchase out of pocket (no mortgage). Lucy's annual cost of ownership net of tax savings is exactly equal to the annual rent she would have paid to live in the same house. Find the IRR of Lucy's investment. O-16.62 O 16.62 O 0.51 O 6.17 O 5.26 QUESTION 18 How much more could Lucy bid for the house to keep the IRR nonnegative? A longer explanation: how many dollars you can add to 200,000 so that IRR goes down to zero. Buying costs still apply (e.g. if you bid extra $100. you actually pay extra $105). Keep the selling price the same as in Q17 (i.e. if you bid more, the selling cash flow does not go up). Hint: this question is designed to be done with financial calculator, not with a regular calculator

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts