Question: QUESTION 17 Lofty Lumber Ltd is considering purchasing a new wood saw that costs $50,000. The saw will generate revenues of $120,000 per year for

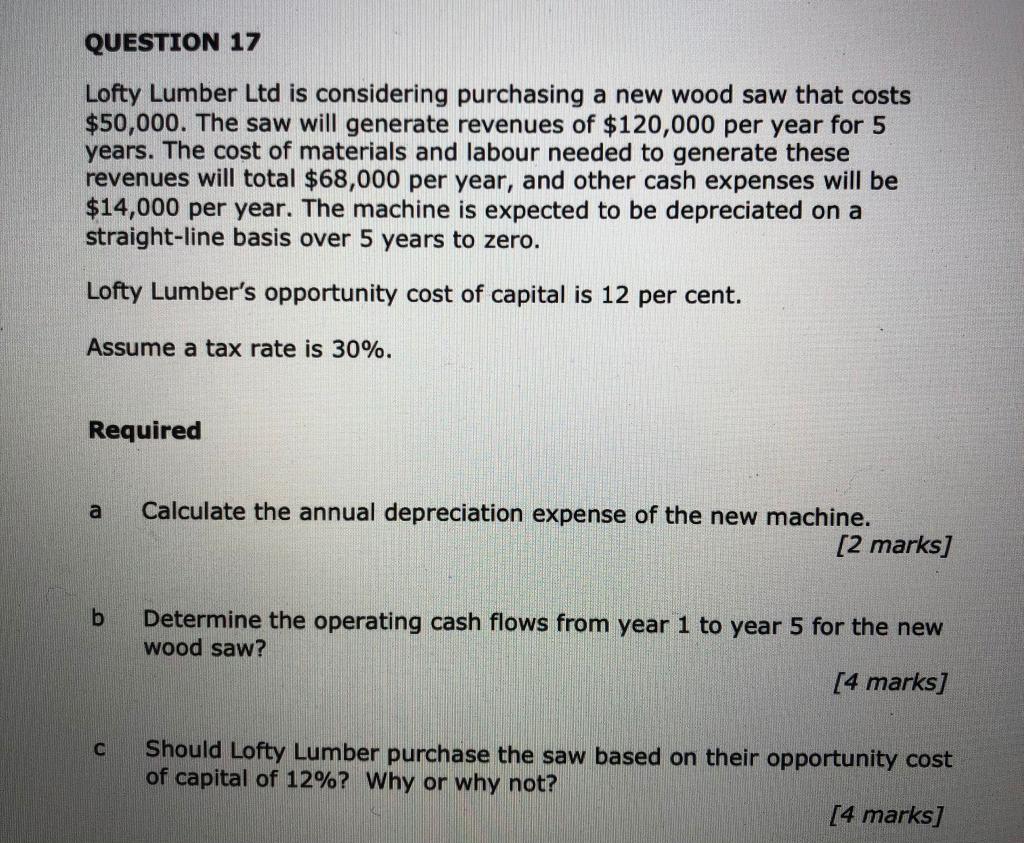

QUESTION 17 Lofty Lumber Ltd is considering purchasing a new wood saw that costs $50,000. The saw will generate revenues of $120,000 per year for 5 years. The cost of materials and labour needed to generate these revenues will total $68,000 per year, and other cash expenses will be $14,000 per year. The machine is expected to be depreciated on a straight-line basis over 5 years to zero. Lofty Lumber's opportunity cost of capital is 12 per cent. Assume a tax rate is 30%. Required a Calculate the annual depreciation expense of the new machine. [2 marks] b Determine the operating cash flows from year 1 to year 5 for the new wood saw? [4 marks] C Should Lofty Lumber purchase the saw based on their opportunity cost of capital of 12%? Why or why not? [4 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts