Question: QUESTION 17 Match each term. Long position in a call option. Short position in a call option Long position in a put option Short position

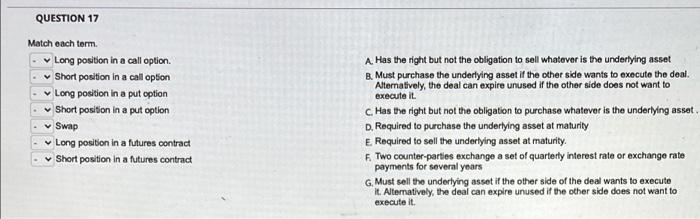

QUESTION 17 Match each term. Long position in a call option. Short position in a call option Long position in a put option Short position in a put option Swap Long position in a futures contract Short position in a futures contract A. Has the right but not the obligation to sell whatever is the underlying asset B. Must purchase the underlying asset if the other side wants to execute the deal. Alternatively, the deal can expire unused if the other side does not want to execute it. C. Has the right but not the obligation to purchase whatever is the underlying asset. D. Required to purchase the underlying asset at maturity E. Required to sell the underlying asset at maturity. F. Two counter-parties exchange a set of quarterly interest rate or exchange rate payments for several years G. Must sell the underlying asset if the other side of the deal wants to execute it. Alternatively, the deal can expire unused if the other side does not want to execute it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts