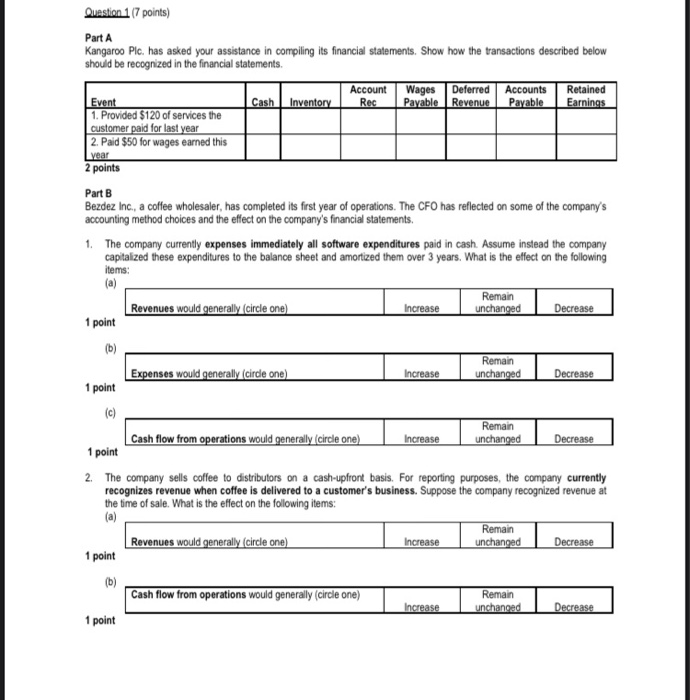

Question: Question 17 points) Part A Kangaroo Plc. has asked your assistance in compiling its financial statements. Show how the transactions described below should be recognized

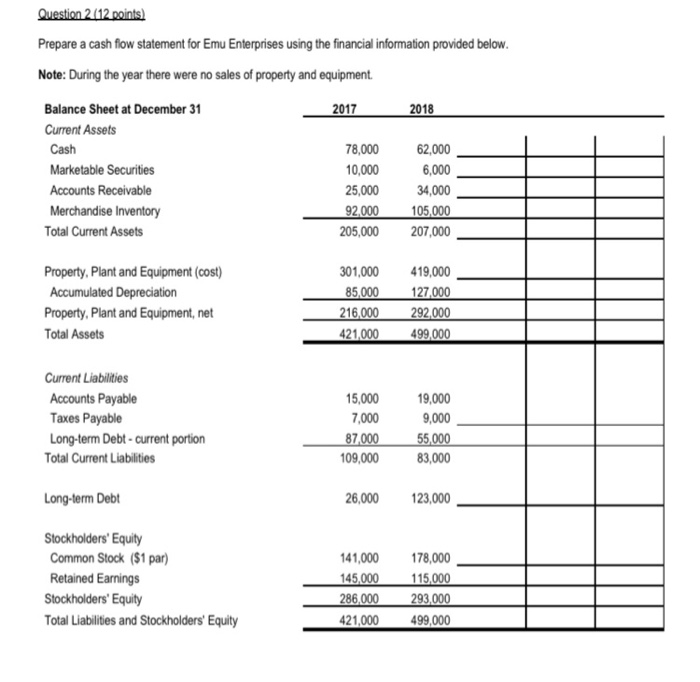

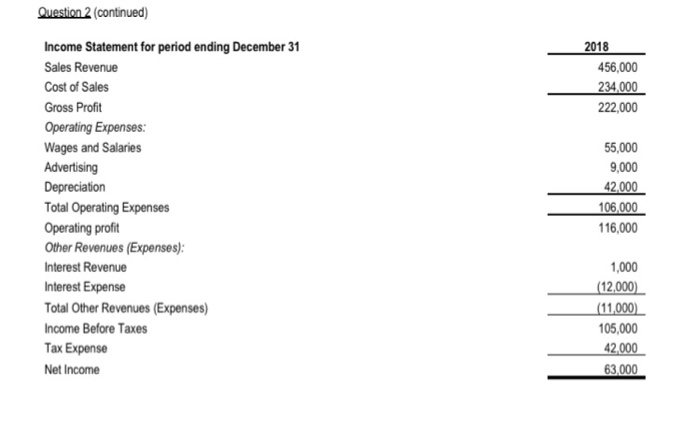

Question 17 points) Part A Kangaroo Plc. has asked your assistance in compiling its financial statements. Show how the transactions described below should be recognized in the financial statements. Cash Inventory | Account Rec Wages P ayable Deferred Revenue Accounts Payable Retained Earnings Event 1. Provided $120 of services the customer paid for last year 2. Paid $50 for wages earned this year 2 points Part B Bezdez Inc., a coffee wholesaler, has completed its first year of operations. The CFO has reflected on some of the company's accounting method choices and the effect on the company's financial statements. 1. The company currently expenses immediately all software expenditures paid in cash. Assume instead the company capitalized these expenditures to the balance sheet and amortized them over 3 years. What is the effect on the following items: Revenues would generally (circle one) Remain unchanged Increase Decrease 1 point Expenses would generally (circle one) Remain unchanged Increase Decrease 1 point Cash flow from operations would generally circle one) Increase the Remain unchanged rest Decrease Increase Decrease 1 point The company sells coffee to distributors on a cash-upfront basis. For reporting purposes, the company currently recognizes revenue when coffee is delivered to a customer's business. Suppose the company recognized revenue at the time of sale. What is the effect on the following items: Revenues would generally (circle one) Revenues would generally (circle one) Increase Increase Remain unchanged un Decrease Decrease 1 point Cash flow from operations would generally (circle one) Remain unchanged Increase Decrease 1 point Question 2 (12 points) Prepare a cash flow statement for Emu Enterprises using the financial information provided below. Note: During the year there were no sales of property and equipment. - 2017 2018 62,000 Balance Sheet at December 31 Current Assets Cash Marketable Securities Accounts Receivable Merchandise Inventory Total Current Assets 78,000 10,000 25,000 92,000 205,000 6,000 34,000 105,000 207,000 Property, Plant and Equipment (cost) Accumulated Depreciation Property, Plant and Equipment, net Total Assets 301.000 85,000 216.000 421,000 419,000 127,000 292.000 499,000 Current Liabilities Accounts Payable Taxes Payable Long-term Debt - current portion Total Current Liabilities 15,000 7,000 87.000 109,000 19,000 9,000 55.000 83,000 Long-term Debt 26,000 123,000 Stockholders' Equity Common Stock ($1 par) Retained Earnings Stockholders' Equity Total Liabilities and Stockholders' Equity 141,000 145,000 286,000 421,000 178,000 115,000 293,000 499,000 Question 2 (continued) 2018 456,000 234,000 222,000 budhal Income Statement for period ending December 31 Sales Revenue Cost of Sales Gross Profit Operating Expenses: Wages and Salaries Advertising Depreciation Total Operating Expenses Operating profit Other Revenues (Expenses): Interest Revenue Interest Expense Total Other Revenues (Expenses) Income Before Taxes Tax Expense Net Income 55,000 9,000 42,000 106,000 116,000 1,000 (12,000 (11.000) 105,000 42,000 63.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts