Question: = = Question 17. There are two APT factors in the economy which describe the returns of stocks. Consider the following factor model for the

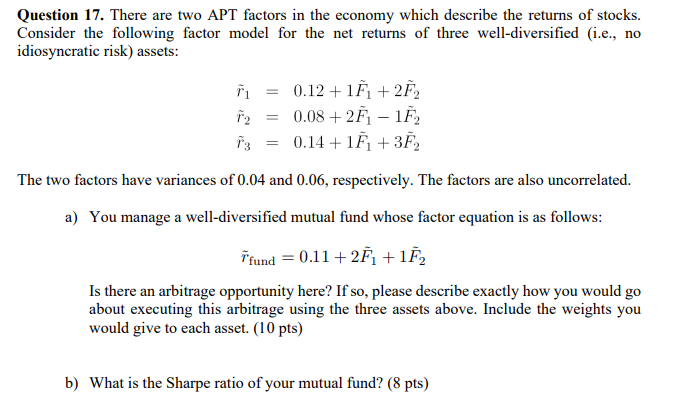

= = Question 17. There are two APT factors in the economy which describe the returns of stocks. Consider the following factor model for the net returns of three well-diversified (i.e., no idiosyncratic risk) assets: ri 0.12 +1 +272 a 0.08 +271 - 0.14+1F +372 The two factors have variances of 0.04 and 0.06, respectively. The factors are also uncorrelated. a) You manage a well-diversified mutual fund whose factor equation is as follows: fund = 0.11 +27 +1}, Is there an arbitrage opportunity here? If so, please describe exactly how you would go about executing this arbitrage using the three assets above. Include the weights you would give to each asset. (10 pts) b) What is the Sharpe ratio of your mutual fund? (8 pts) = = Question 17. There are two APT factors in the economy which describe the returns of stocks. Consider the following factor model for the net returns of three well-diversified (i.e., no idiosyncratic risk) assets: ri 0.12 +1 +272 a 0.08 +271 - 0.14+1F +372 The two factors have variances of 0.04 and 0.06, respectively. The factors are also uncorrelated. a) You manage a well-diversified mutual fund whose factor equation is as follows: fund = 0.11 +27 +1}, Is there an arbitrage opportunity here? If so, please describe exactly how you would go about executing this arbitrage using the three assets above. Include the weights you would give to each asset. (10 pts) b) What is the Sharpe ratio of your mutual fund? (8 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts