Question: QUESTION 17 Think about the relationship between bond prices and interest rates. Assume for a second that interest rates have just gone up. The the

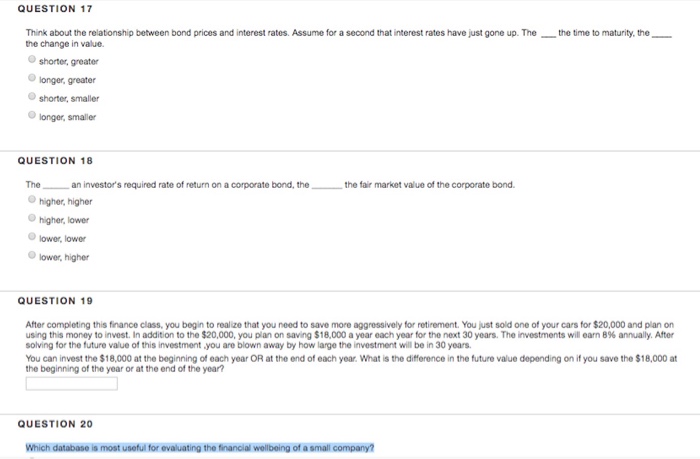

QUESTION 17 Think about the relationship between bond prices and interest rates. Assume for a second that interest rates have just gone up. The the time to maturity, the the change in value. shorter, greater longer, greater shorter, smaller O longer, smaller QUESTION 18 The an investor's required rate of return on a corporate bond, the the fair market value of the corporate bond. higher, higher higher, lower lower, lower lower, higher QUESTION 19 After completing this finance class, you begin to realize that you need to save more aggressively for retirement. You just sold one of your cars for $20,000 and plan on using this mon0y to invest. In addition to the $20,000, you plan on sav ng $18,000 a year 0ach year for the next 30 years. The investments will earn 8% annually. After solving for the future value of this investment you are blown away by how large the investment will be in 30 years You can invest the $18,000 at the beginning of each year OR at the end of each year. What is the difference in the future value depending on if you save the $18,000 at the beginning of the year or at the end of the yearn QUESTION 20 Which database is most useful for evaluating the financial wellbeing of a small company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts