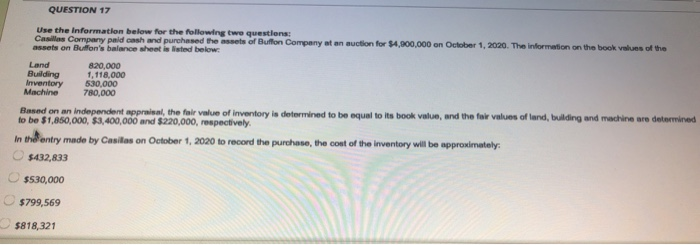

Question: QUESTION 17 Use the information below for the following two questions: Casillas Company paid cash and purchased the assets of Buffon Company at an auction

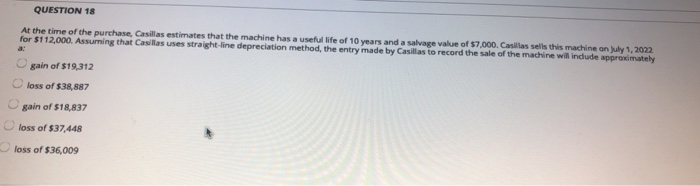

QUESTION 17 Use the information below for the following two questions: Casillas Company paid cash and purchased the assets of Buffon Company at an auction for $4,000,000 on October 1, 2020. The information on the book values of the assets on Buffon's balance sheet is listed below: Land 8.20,000 Building 1,118,000 Inventory 530,000 Machine 780,000 Based on an independent appraisal, the fair value of inventory in determined to be equal to its book value, and the fair values of land, building and machine are determined to be $1,850,000, $3,400,000 and $220,000, respectively In the entry made by Casillas on October 1, 2020 to record the purchase, the cost of the inventory will be approximately $432,833 $530,000 $799,569 $818,321 QUESTION 18 At the time of the purchase, Casillas estimates that the machine has a useful life of 10 years and a salvage value of $7,000. Casillas sells this machine on July 1, 2022 for $112,000. Assuming that Casillas uses straight-line depreciation method, the entry made by Casillas to record the sale of the machine willindude approximately gain of $19,312 loss of $38,887 gain of $18,837 loss of $37,448 loss of $36,009

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts