Question: Question 18 (1 point) Your independent project has an initial cash outflow (-) followed by six years of cash inflows (t), and concluding with a

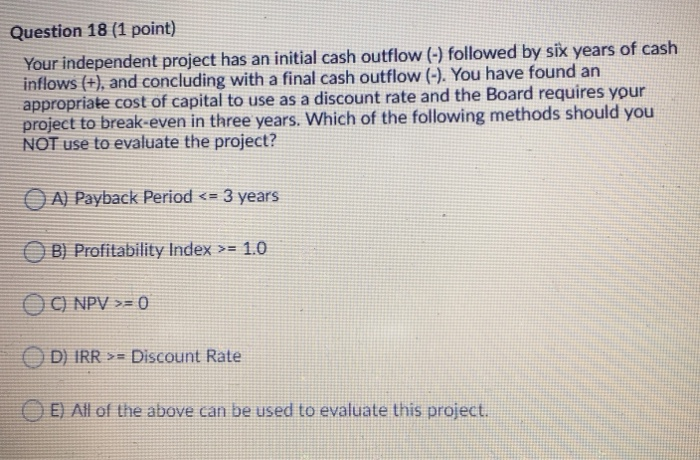

Question 18 (1 point) Your independent project has an initial cash outflow (-) followed by six years of cash inflows (t), and concluding with a final cash outflow (-). You have found an appropriate cost of capital to use as a discount rate and the Board requires your project to break-even in three years. Which of the following methods should you NOT use to evaluate the project? A) Payback Period = 1.0 C) NPV >= 0 D) IRR >= Discount Rate OE) All of the above can be used to evaluate this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts