Question: Question 18 1 pts A 2 Data for Dana Industries is shown below. Now Dana acquires some risky assets that cause its beta to increase

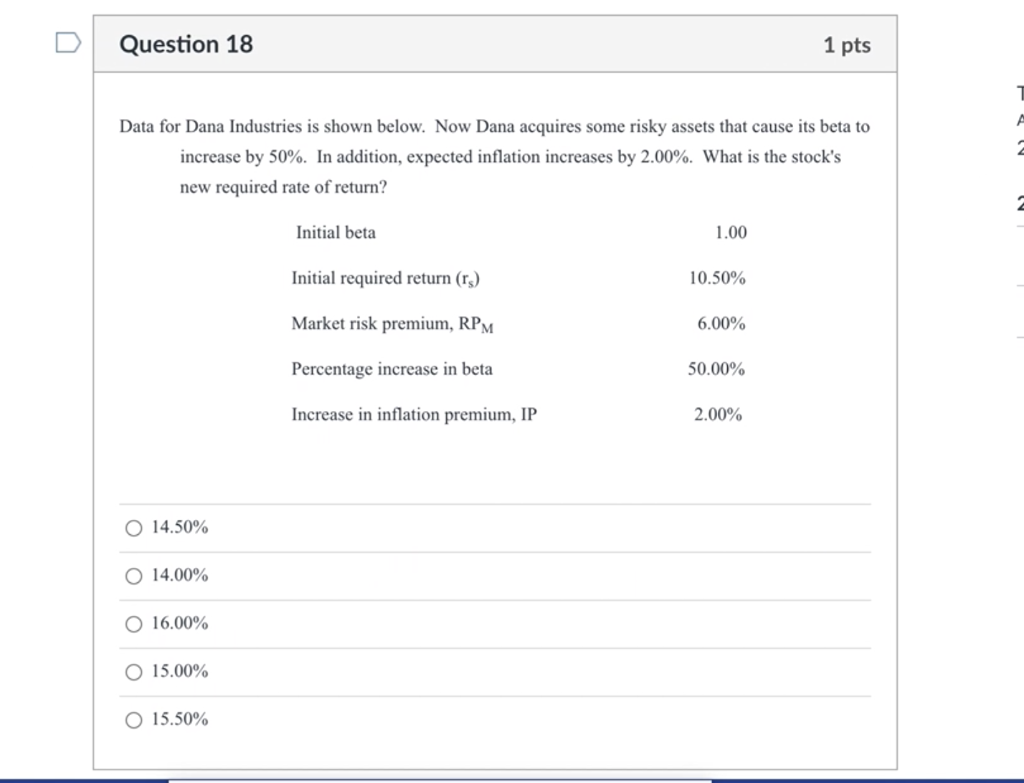

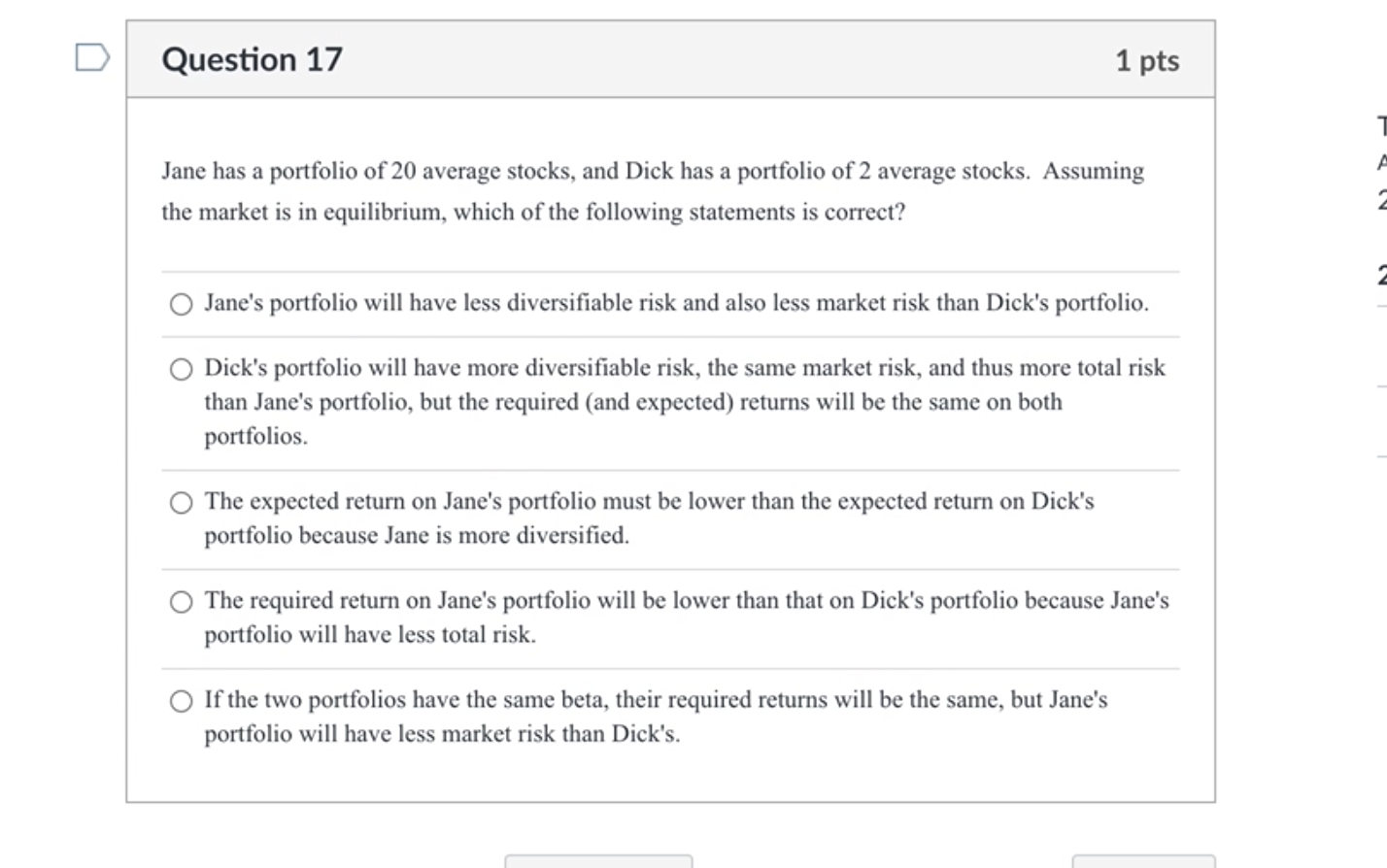

Question 18 1 pts A 2 Data for Dana Industries is shown below. Now Dana acquires some risky assets that cause its beta to increase by 50%. In addition, expected inflation increases by 2.00%. What is the stock's new required rate of return? Initial beta 1.00 Initial required return (rs) 10.50% Market risk premium, RPM 6.00% Percentage increase in beta 50.00% Increase in inflation premium, IP 2.00% O 14.50% 14.00% 16.00% 15.00% O 15.50% Question 17 1 pts Jane has a portfolio of 20 average stocks, and Dick has a portfolio of 2 average stocks. Assuming the market is in equilibrium, which of the following statements is correct? Jane's portfolio will have less diversifiable risk and also less market risk than Dick's portfolio. Dick's portfolio will have more diversifiable risk, the same market risk, and thus more total risk than Jane's portfolio, but the required and expected) returns will be the same on both portfolios. The expected return on Jane's portfolio must be lower than the expected return on Dick's portfolio because Jane is more diversified. The required return on Jane's portfolio will be lower than that on Dick's portfolio because Jane's portfolio will have less total risk. If the two portfolios have the same beta, their required returns will be the same, but Jane's portfolio will have less market risk than Dick's

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts