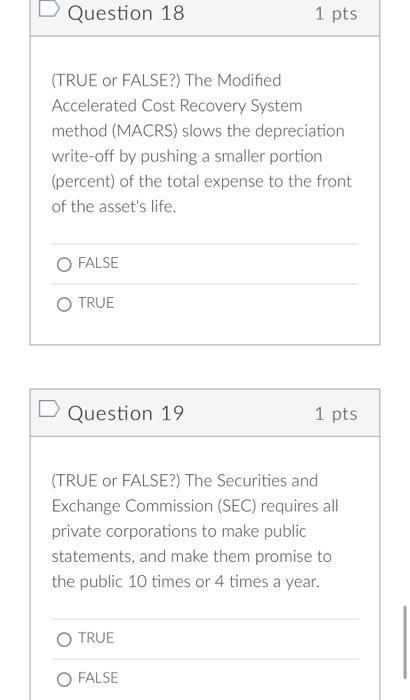

Question: Question 18 1 pts (TRUE or FALSE?) The Modified Accelerated Cost Recovery System method (MACRS) slows the depreciation write-off by pushing a smaller portion (percent)

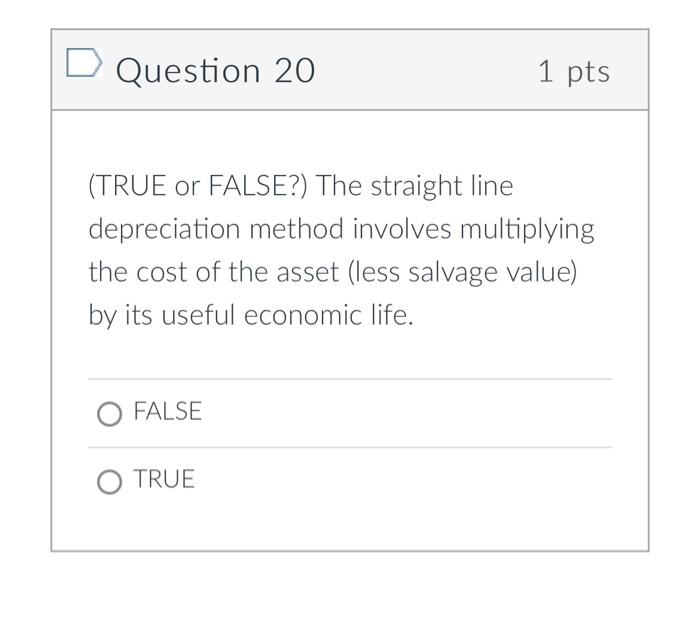

Question 18 1 pts (TRUE or FALSE?) The Modified Accelerated Cost Recovery System method (MACRS) slows the depreciation write-off by pushing a smaller portion (percent) of the total expense to the front of the asset's life. FALSE TRUE D Question 19 1 pts (TRUE or FALSE?) The Securities and Exchange Commission (SEC) requires all private corporations to make public statements, and make them promise to the public 10 times or 4 times a year. TRUE FALSE Question 20 1 pts (TRUE or FALSE?) The straight line depreciation method involves multiplying the cost of the asset (less salvage value) by its useful economic life. FALSE O TRUE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts