Question: Question 18 2 pts At December 31, Gill Co reported accounts receivable of $238,000 and an allowance for uncollectible accounts of $600 (credit) before adjustment.

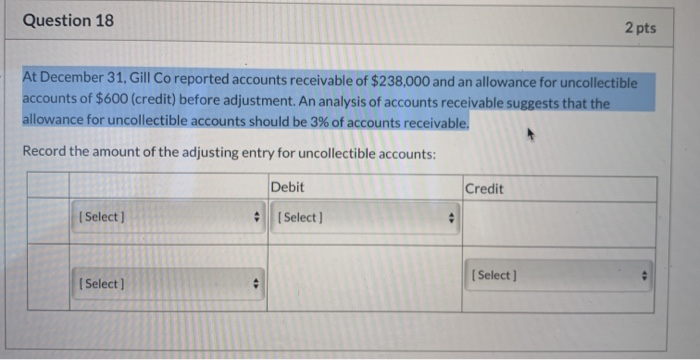

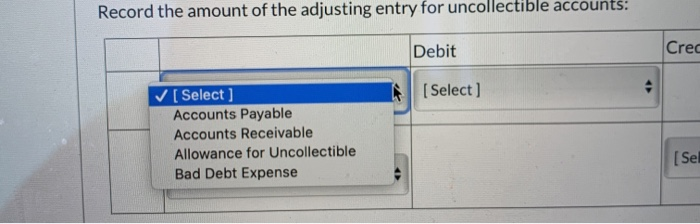

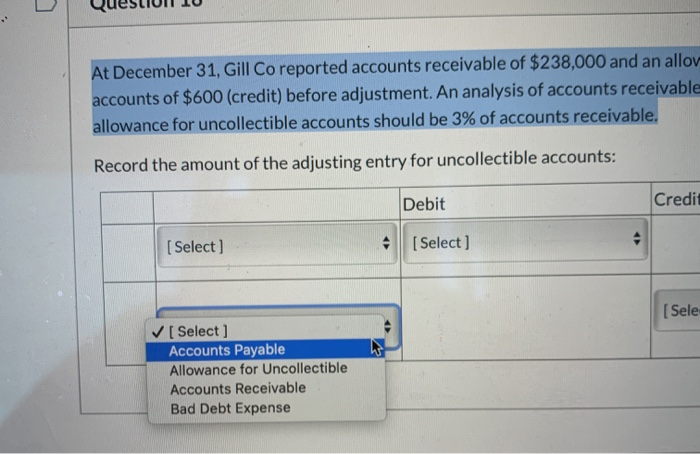

Question 18 2 pts At December 31, Gill Co reported accounts receivable of $238,000 and an allowance for uncollectible accounts of $600 (credit) before adjustment. An analysis of accounts receivable suggests that the allowance for uncollectible accounts should be 3% of accounts receivable. Record the amount of the adjusting entry for uncollectible accounts: Debit Credit [Select) Select) (Select) [Select) Record the amount of the adjusting entry for uncollectible accounts: Debit Crec (Select) [Select] Accounts Payable Accounts Receivable Allowance for Uncollectible Bad Debt Expense [Sel At December 31, Gill Co reported accounts receivable of $238,000 and an allov- accounts of $600 (credit) before adjustment. An analysis of accounts receivable allowance for uncollectible accounts should be 3% of accounts receivable. Record the amount of the adjusting entry for uncollectible accounts: Debit Credit [ Select) [Select) [Sele Select ] Accounts Payable Allowance for Uncollectible Accounts Receivable Bad Debt Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts