Question: Question 18 3 points Save Answer You should use below information for the following 3 questions (Q18-Q20). Alpha Corporation has just paid its annual dividend

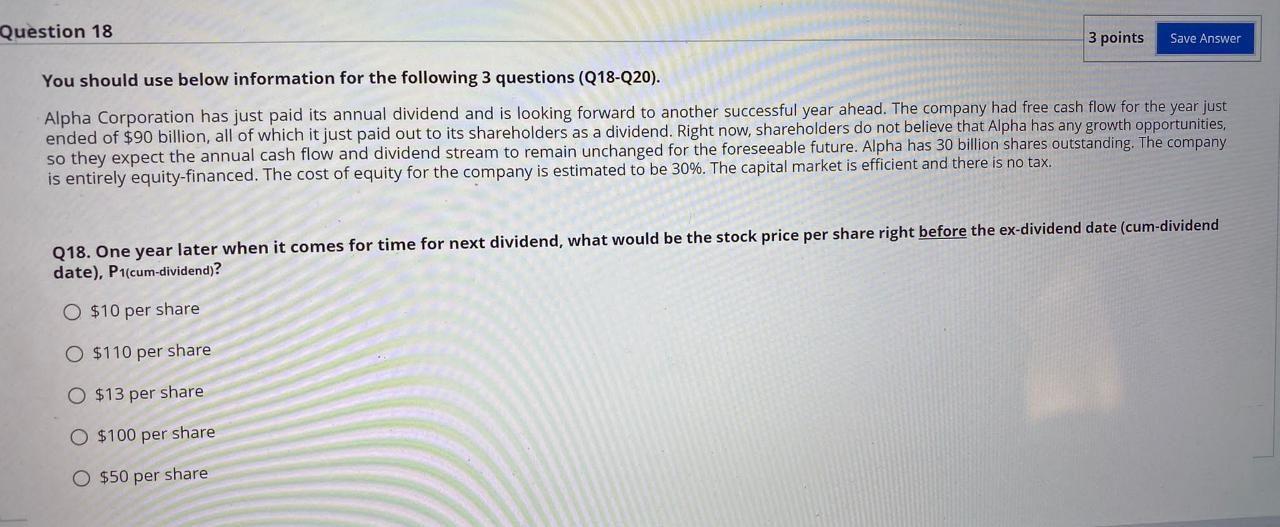

Question 18 3 points Save Answer You should use below information for the following 3 questions (Q18-Q20). Alpha Corporation has just paid its annual dividend and is looking forward to another successful year ahead. The company had free cash flow for the year just ended of $90 billion, all of which it just paid out to its shareholders as a dividend. Right now, shareholders do not believe that Alpha has any growth opportunities, so they expect the annual cash flow and dividend stream to remain unchanged for the foreseeable future. Alpha has 30 billion shares outstanding. The company is entirely equity-financed. The cost of equity for the company is estimated to be 30%. The capital market is efficient and there is no tax. Q18. One year later when it comes for time for next dividend, what would be the stock price per share right before the ex-dividend date (cum-dividend date), P1(cum-dividend)? O $10 per share O $110 per share O $13 per share O $100 per share O $50 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts