Question: Question 18 3 points Save Antwer A corporation is evaluating the relevant cash flows for a capital budgeting decision and must estimate the terminal cash

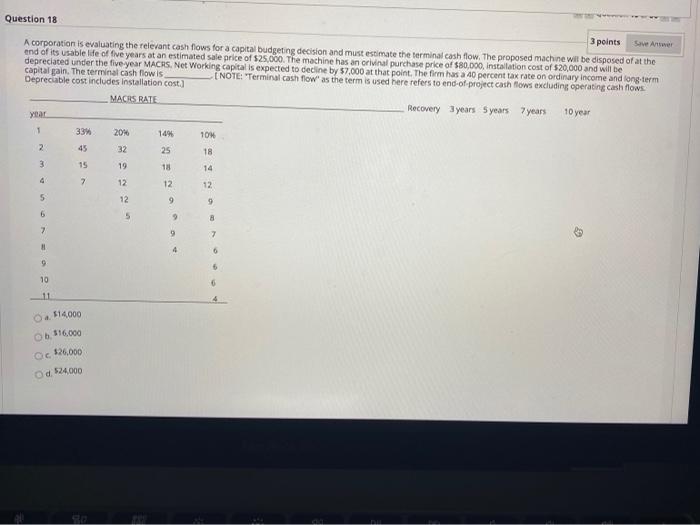

Question 18 3 points Save Antwer A corporation is evaluating the relevant cash flows for a capital budgeting decision and must estimate the terminal cash flow. The proposed machine will be disposed of at the end of its usable life of five years at an estimated sale price of $25,000. The machine has an orivinal purchase price of $80,000 Installation cost of $20,000 and will be depreciated under the five year MACHS. Net Working capital is expected to decline by 57.000 at that point. The firm has a 40 percent tax rate on ordinary income and long-term capital gain. The terminal cash flow is NOTE: Terminal cash flow' as the term is used here refers to end-of project cash flows excluding operating cash flows Depreciable cost includes installation cost.] MACRS RATE Recovery 3 years 5 years 7 years 10 year year 1 33% 20% 149 10 2 45 32 25 18 3 15 18 14 7 12 12 12 19 5 12 9 6 5 9 8 7 7 6 9 6 10 0.514.000 6.516.000 Oc 526.000 Od. 524.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts