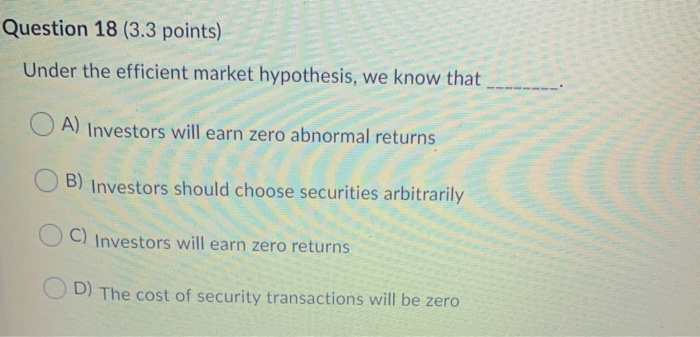

Question: Question 18 (3.3 points) Under the efficient market hypothesis, we know that! OA) Investors will earn zero abnormal returns B) Investors should choose securities arbitrarily

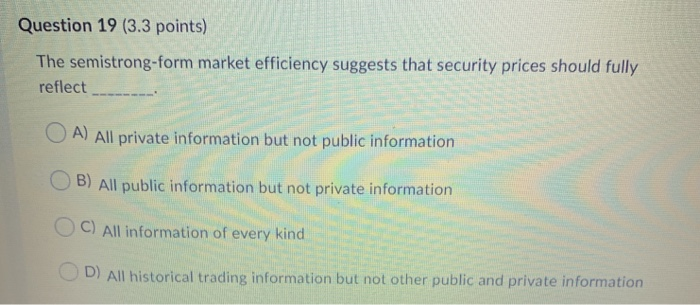

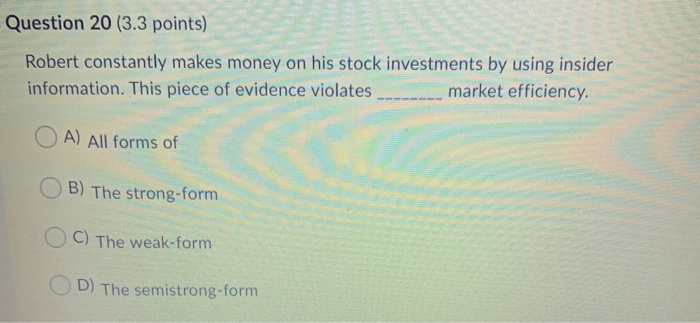

Question 18 (3.3 points) Under the efficient market hypothesis, we know that! OA) Investors will earn zero abnormal returns B) Investors should choose securities arbitrarily OC) Investors will earn zero returns O D) The cost of security transactions will be zero Question 19 (3.3 points) The semistrong-form market efficiency suggests that security prices should fully reflect OA) All private information but not public information OB) All public information but not private information C) All information of every kind D) All historical trading information but not other public and private information Question 20 (3.3 points) Robert constantly makes money on his stock investments by using insider information. This piece of evidence violates market efficiency. OA) All forms of A) All forms of OB) The strong-form C) The weak-form OD The semistrong-form

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts