Question: QUESTION 18 4 points Save Answer Axis Credit wants to earn an effective annual return on its consumer loans of 22% per year. The financing

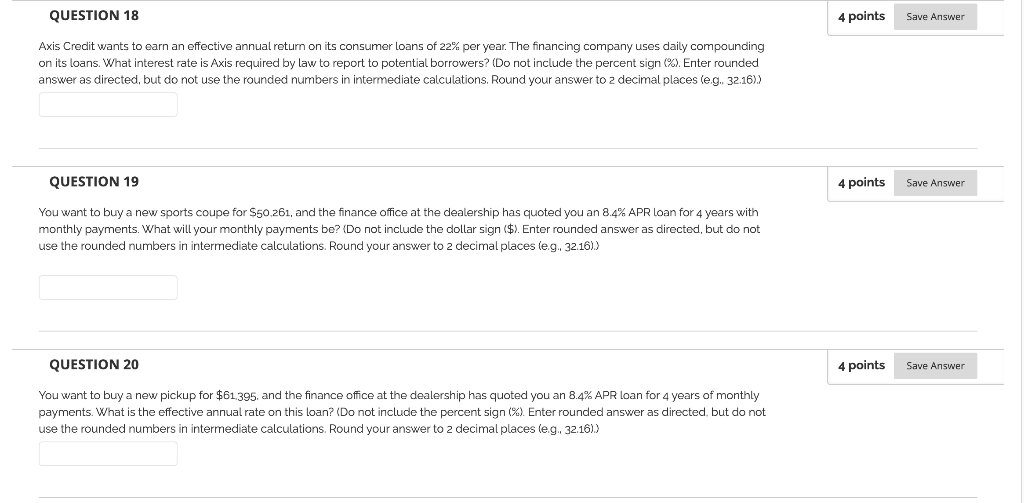

QUESTION 18 4 points Save Answer Axis Credit wants to earn an effective annual return on its consumer loans of 22% per year. The financing company uses daily compounding on its loans. What interest rate is Axis required by law to report to potential borrowers? (Do not include the percent sign%). Enter rounded answer as directed, but do not use the rounded numbers in intermediate calculations. Round your answer to 2 decimal places leg. 32.16). QUESTION 19 4 points Save Answer You want to buy a new sports coupe for $50.261, and the finance office at the dealership has quoted you an 8.4% APR loan for 4 years with monthly payments. What will your monthly payments be? (Do not include the dollar sign ($). Enter rounded answer as directed, but do not use the rounded numbers in intermediate calculations. Round your answer to 2 decimal places leg. 32.16).) QUESTION 20 4 points Save Answer You want to buy a new pickup for $61.395, and the finance office at the dealership has quoted you an 8.4% APR loan for 4 years of monthly payments. What is the effective annual rate on this loan? (Do not include the percent sign (0) Enter rounded answer as directed, but do not use the rounded numbers in intermediate calculations. Round your answer to 2 decimal places leg. 32.16).)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts