Question: Question 18 (5 points) LaPango Inc. estimates that its average-risk projects have a WACC of 10%, its below average risk projects have a WACC of

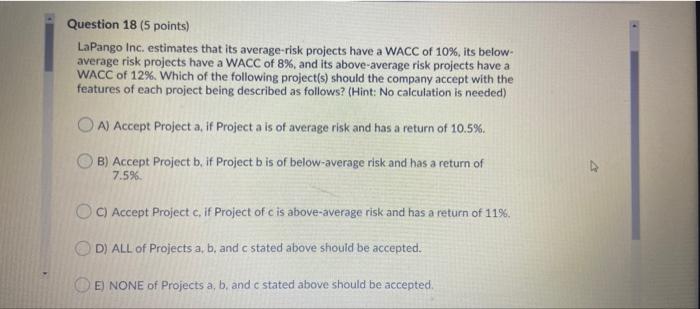

Question 18 (5 points) LaPango Inc. estimates that its average-risk projects have a WACC of 10%, its below average risk projects have a WACC of 8%, and its above-average risk projects have a WACC of 12%. Which of the following project(s) should the company accept with the features of each project being described as follows? (Hint: No calculation is needed) O A) Accept Project a, if Project a is of average risk and has a return of 10.5%. B) Accept Project b, if Project bis of below-average risk and has a return of 7.5% OC) Accept Project c. if Project of cis above-average risk and has a return of 11%. D) ALL of Projects a, b, and c stated above should be accepted. E) NONE of Projects a, b, and a stated above should be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts