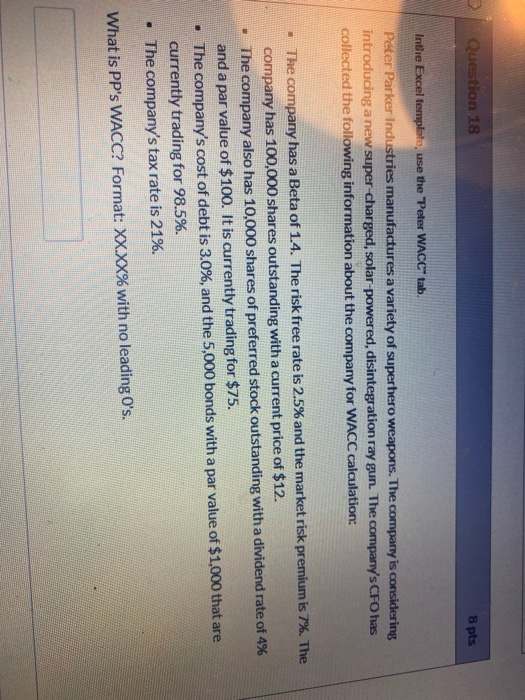

Question: Question 18 8 pts Inthe Excel template, use the Peter WACC tab. Peter Parker Industries manufactures a variety of superhero weapons. The company is considering

Question 18 8 pts Inthe Excel template, use the "Peter WACC tab. Peter Parker Industries manufactures a variety of superhero weapons. The company is considering introducing a new super-charged, solar powered, disintegration ray gun. The company's CFO has collected the following information about the company for WACC calculation: The company has a Beta of 1.4. The risk free rate is 2.5% and the market risk premium is 7%. The company has 100,000 shares outstanding with a current price of $12. The company also has 10,000 shares of preferred stock outstanding with a dividend rate of 4% and a par value of $100. It is currently trading for $75. The company's cost of debt is 3.0%, and the 5,000 bonds with a par value of $1,000 that are currently trading for 98.5%. The company's tax rate is 21%. What is PP's WACC? Format: XX.XX% with no leading O's

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts