Question: QUESTION 18 Having finished your Intermediate accounting course with excellent grades, your boss called you to her office and gave you the following data for

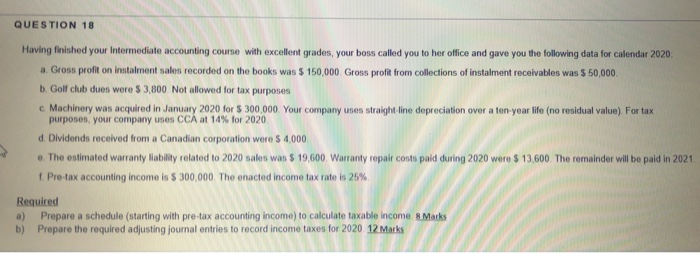

QUESTION 18 Having finished your Intermediate accounting course with excellent grades, your boss called you to her office and gave you the following data for calendar 2020 a. Gross profit on instalment sales recorded on the books was $ 150,000. Gross profit from collections of instalment receivables was $ 50,000 b. Golf club dues were 3 3,800 Not allowed for tax purposes c. Machinery was acquired in January 2020 for $ 300,000. Your company uses straight-line depreciation over a ten-year life (no residual value). For tax purposes, your company uses CCA at 14% for 2020 d Dividends received from a Canadian corporation were $ 4,000 e. The estimated warranty Hability related to 2020 sales was $ 19,600. Warranty repair costs paid during 2020 were $ 13,600. The remainder will be paid in 2021 Pro-tax accounting income is $ 300,000. The enacted income tax rate is 25% Required a) Prepare a schedule (starting with pre-tax accounting income) to calculate taxable income 8 Marks b) Prepare the required adjusting journal entries to record income taxes for 2020 12 Marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts