Question: QUESTION 18 Jack started a new accounting practice. He purchased $35,000 of computer equipment and placed the equipment in service in May. (Here is MARCS

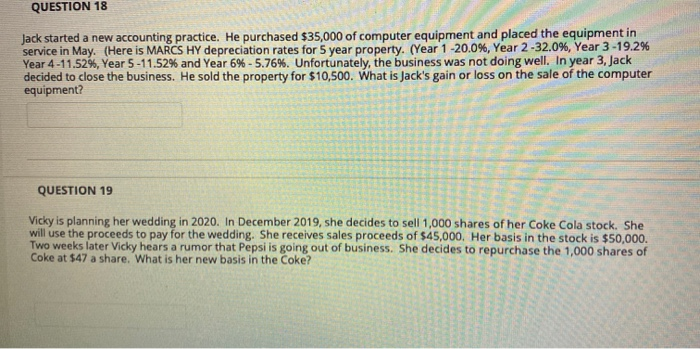

QUESTION 18 Jack started a new accounting practice. He purchased $35,000 of computer equipment and placed the equipment in service in May. (Here is MARCS HY depreciation rates for 5 year property. (Year 1-20.0%, Year 2-32.0%, Year 3-19.2% Year 4-11.529, Year 5 -11.52% and Year 6% -5.76%. Unfortunately, the business was not doing well. In year 3, Jack decided to close the business. He sold the property for $10,500. What is Jack's gain or loss on the sale of the computer equipment? QUESTION 19 Vicky is planning her wedding in 2020. In December 2019, she decides to sell 1,000 shares of her Coke Cola stock. She will use the proceeds to pay for the wedding. She receives sales proceeds of $45,000. Her basis in the stock is $50,000. Two weeks later Vicky hears a rumor that Pepsi is going out of business. She decides to repurchase the 1,000 shares of Coke at $47 a share. What is her new basis in the Coke

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts