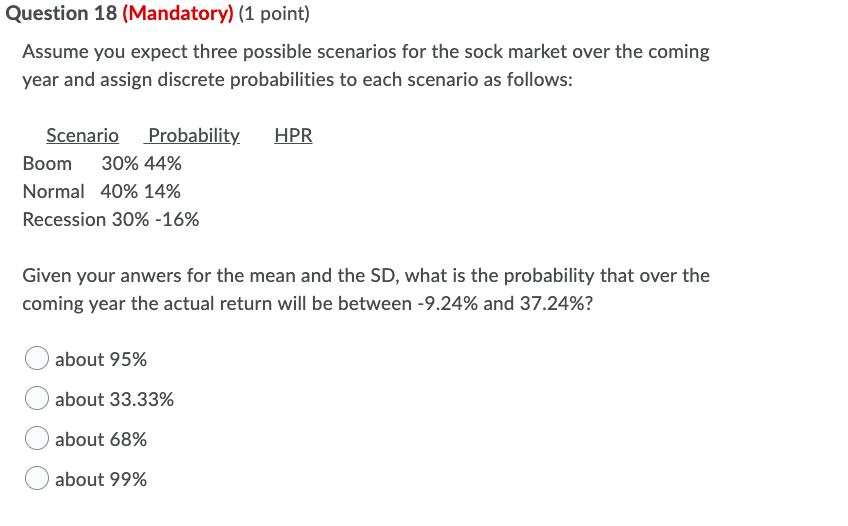

Question: Question 18 (Mandatory) (1 point) Assume you expect three possible scenarios for the sock market over the coming year and assign discrete probabilities to each

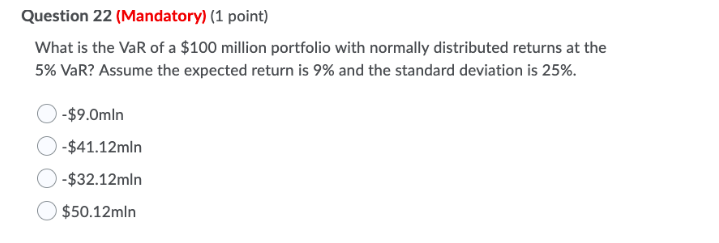

Question 18 (Mandatory) (1 point) Assume you expect three possible scenarios for the sock market over the coming year and assign discrete probabilities to each scenario as follows: HPR Scenario Probability. Boom 30% 44% Normal 40% 14% Recession 30% -16% Given your anwers for the mean and the SD, what is the probability that over the coming year the actual return will be between -9.24% and 37.24%? O about 95% about 33.33% O about 68% O about 99% Question 22 (Mandatory) (1 point) What is the VaR of a $100 million portfolio with normally distributed returns at the 5% VaR? Assume the expected return is 9% and the standard deviation is 25%. -$9.0mln O-$41.12min 0-$32.12mln $50.12min

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts