Question: Question 18 Question 22 QUESTION 18 On September 1, 2019, Westwood Bulders borrowed $200,000 from Colorado State Bank by issuing a 7-month, $200,000,6% note. Westwood

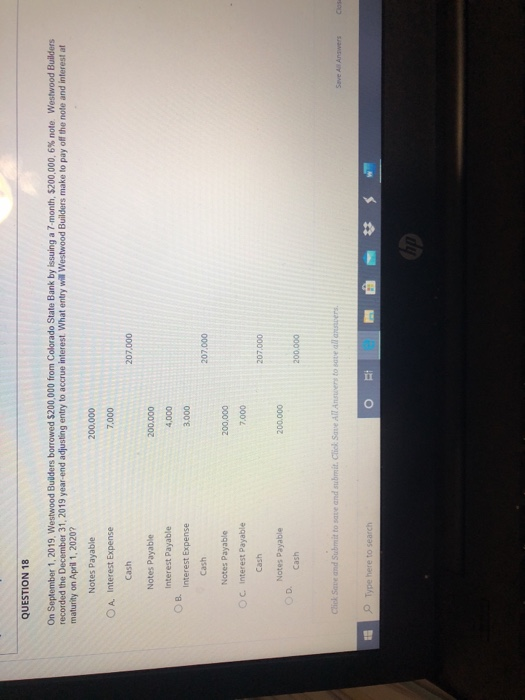

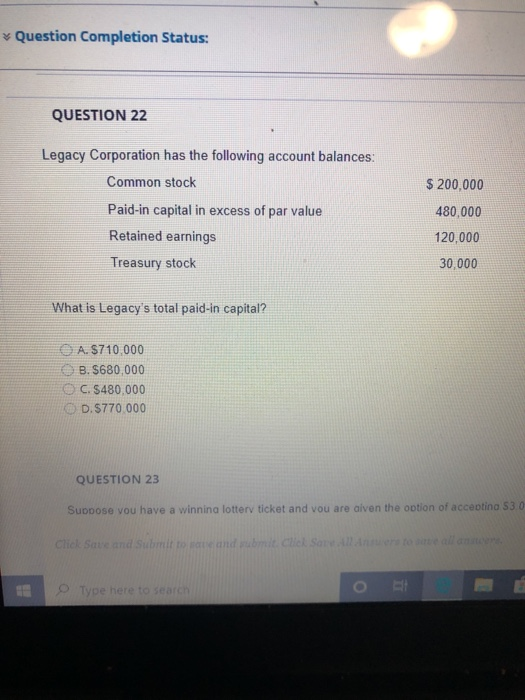

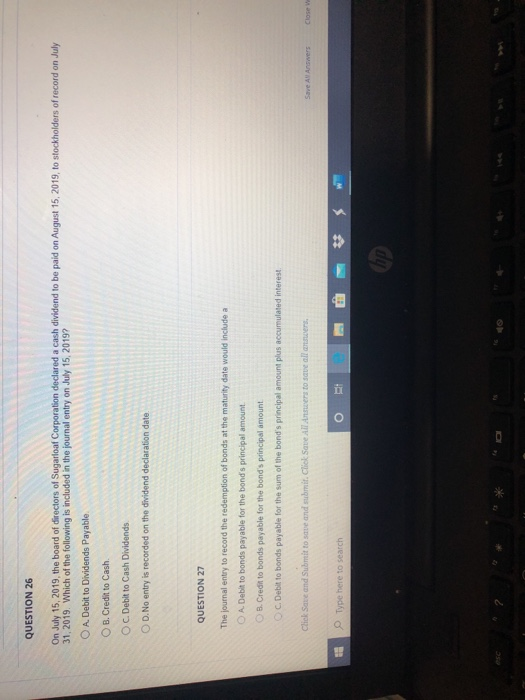

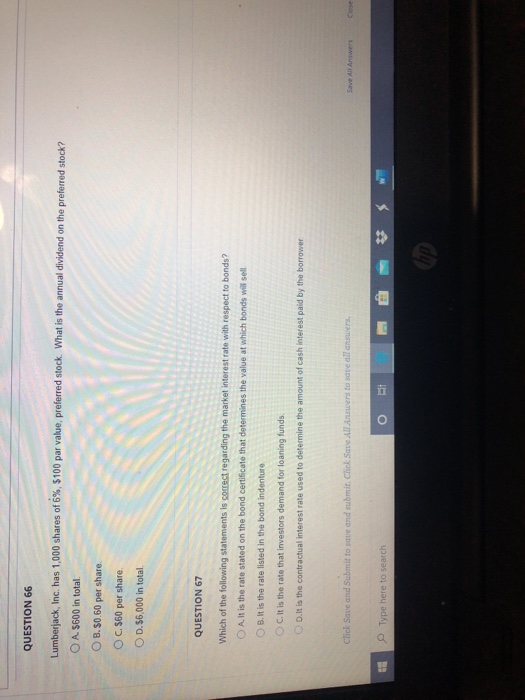

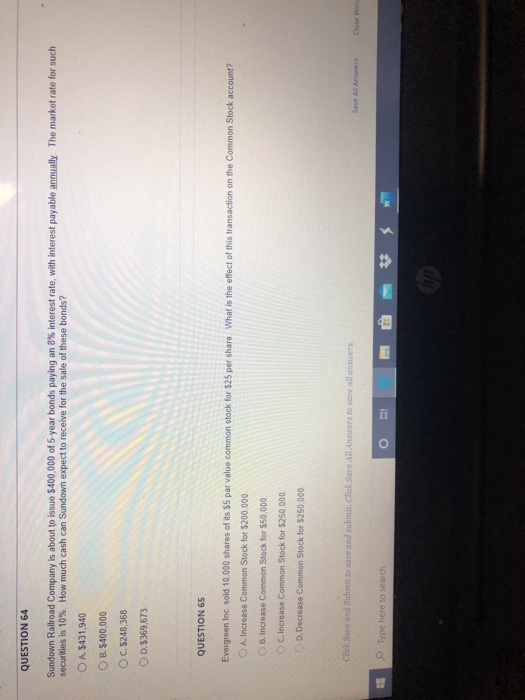

QUESTION 18 On September 1, 2019, Westwood Bulders borrowed $200,000 from Colorado State Bank by issuing a 7-month, $200,000,6% note. Westwood Builders maturity on April 1, 2020? recorded the December 31, 2019 year-end adjusting entry to accrue interest What entry will Westwood Builders make to pay off the note and interest at Notes Payable 200.000 O A. Interest Expense 7,000 Cash 207.000 Notes Payable 200.000 Interest Payable 4,000 Interest Expense 3.000 Cash 207.000 Notes Payable 200,000 OC Interest Payable 7,000 Cash 207.000 200.000 Notes Payable OD Cash 200,000 Chick Save and Submit to save and submit. Click Save All Ansters to sate all ansters Save As Answers Close E o Type here to search Question Completion Status: QUESTION 22 Legacy Corporation has the following account balances: Common stock Paid-in capital in excess of par value Retained earnings Treasury stock $ 200,000 480,000 120,000 30,000 What is Legacy's total paid-in capital? A. $710.000 B.$680,000 C. $480,000 D. 5770 000 QUESTION 23 Suppose vou have a winnina lotterv ticket and vou are alven the option of acceptina 530 Chase and submit and e l som E o Type here to search QUESTION 26 On July 15, 2019, the board of directors of Sugarloaf Corporation declared a cash dividend to be paid on August 15, 2019, to stockholders of record on July 31, 2019. Which of the following is included in the journal entry on July 15, 2019? O A. Debit to Dividends Payable OB.Credit to Cash OC. Debit to Cash Dividends. OD. No entry is recorded on the dividend declaration date. QUESTION 27 The journal entry to record the redemption of bonds at the maturity date would include a O A. Debit to bonds payable for the bond's principal amount B. Credit to bonds payable for the bond's principal amount OC. Debit to bonds payable for the sum of the bond's principal amount plus accumulated interest Click Save and Submit to save and submit. Click Save All Answers to save all answers, Save All Answers Close me Type here to search hp QUESTION 66 Lumberjack, Inc. has 1,000 shares of 6%, 5100 par value, preferred stock. What is the annual dividend on the preferred stock? O A $600 in total. O B.50.60 per share OC.560 per share OD. $6,000 in total QUESTION 67 Which of the following statements is correct regarding the market interest rate with respect to bonds? O A. It is the rate stated on the bond certificate that determines the value at which bonds will sell OB.It is the rate listed in the bond indenture C. It is the rate that investors demand for loaning funds D.It is the contractual interest rate used to determine the amount of cash interest paid by the borrower Click Save and Submit to save and submit. Click Save All Answers to save all answers Save All Answers Close Type here to search QUESTION 64 Sundown Railroad Company is about to issue $400,000 of 5-year bonds paying an 8% interest rate, with interest payable annually. The market rate for such securities is 10% How much cash can Sundown expect to receive for the sale of these bonds? O A $431.940 OB. 5400,000 O C. $248,368 OD. $369,673 QUESTION 65 Evergreen Inc. sold 10,000 shares of its $5 par value common stock for $25 per share. What is the effect of this transaction on the Common Stock account? O A. Increase Common Stock for $200.000 B. Increase Common Stock for 550,000 OC. Increase Common Stock for $250.000 D. Decrease Common Stock for $250.000 Click Save and submit to save and submit. Click Save All Answers to save all answers. Save All Answers Close Wine Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts