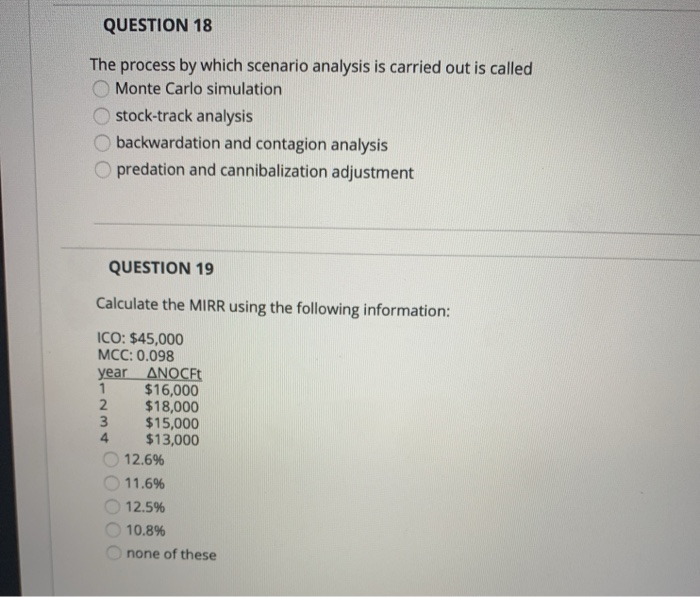

Question: QUESTION 18 The process by which scenario analysis is carried out is called Monte Carlo simulation stock-track analysis backwardation and contagion analysis predation and cannibalization

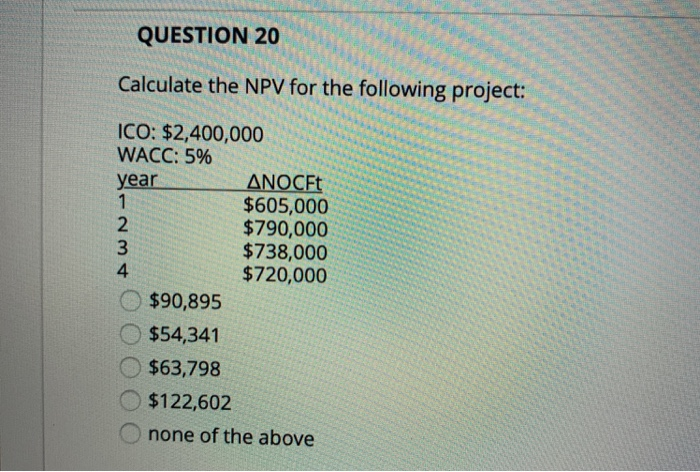

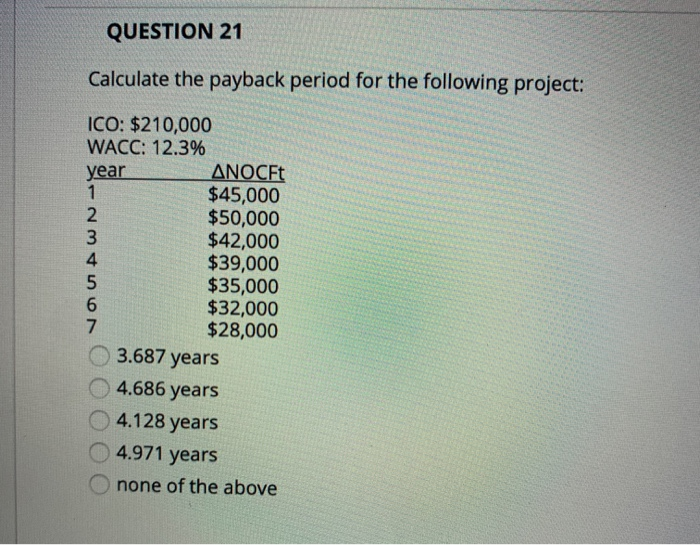

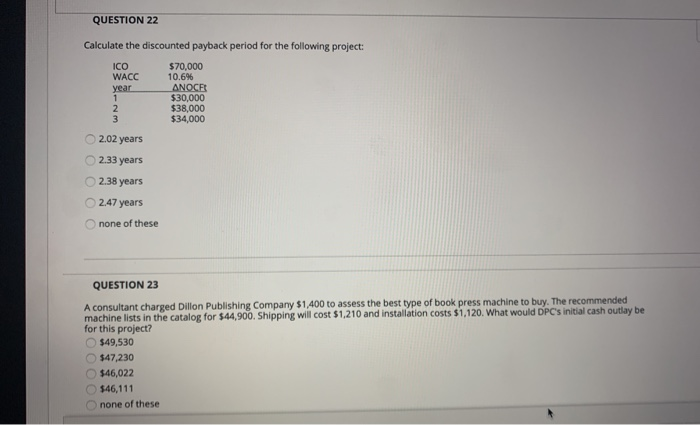

QUESTION 18 The process by which scenario analysis is carried out is called Monte Carlo simulation stock-track analysis backwardation and contagion analysis predation and cannibalization adjustment QUESTION 19 Calculate the MIRR using the following information: 4 ICO: $45,000 MCC: 0.098 year ANOCET $16,000 $18,000 3 $15,000 $13,000 12.6% 11.6% 12.5% 10.8% none of these EES DA QUESTION 20 Calculate the NPV for the following project: AWN ICO: $2,400,000 WACC: 5% year ANOCFT $605,000 $790,000 $738,000 $720,000 $90,895 $54,341 $63,798 $122,602 none of the above QUESTION 21 Calculate the payback period for the following project: VOU AWN- ICO: $210,000 WACC: 12.3% year ANOCFt $45,000 $50,000 $42,000 $39,000 $35,000 $32,000 $28,000 3.687 years 4.686 years 4.128 years 4.971 years none of the above QUESTION 22 Calculate the discounted payback period for the following project: ICO WACC year $70,000 10.6% ANOCR $30,000 $38,000 $34,000 2.02 years 2.33 years 2.38 years 2.47 years none of these QUESTION 23 A consultant charged Dillon Publishing Company $1,400 to assess the best type of book press machine to buy. The recommended machine lists in the catalog for $44,900. Shipping will cost $1,210 and installation costs $1,120. What would DPC's initial cash outlay be for this project? $49,530 $47,230 $46,022 $46,111 none of these

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts